Business, 07.11.2019 07:31 kell22wolf

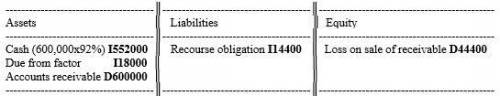

Mini corporation factored, with recourse, $600,000 of accounts receivable with huskie financing. the agreement met all three conditions to be considered an outright sale. huskie advanced 92% of the amount factored and retained the remainder to cover a 3% finance fee (to be remitted at the end of the agreement) and any sales returns/allowances/discounts. the recourse obligation is estimated to be 2.4% of accounts factored. mini estimates the fair value of the final 8% of the receivables factored to be $43,000.

determine the effect of this transaction on mini’s financial position: (use i for increased; d for decreased; or ne for no effect. if there is an effect, state the dollar amount. indicate the letter first, then the number. do not space between the letter and number. do not use commas. for example, if your answer is "decreased by $4,000", enter d4000).

assets

liabilities

equity

blank 1

blank 2

blank 3

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

Barbara jones opened barb’s book business on february 1, 2010. the company specilizes in editing accounting textbooks. you have been hired as manager. your duties include maintaining the company’s financial records. the following transactions occurred in february , the first month of operations. a. received shareholders' cash contributions on february 1 totaling $16,000 to form the corporation; issued 1,000 shares of common stock. b. paid $2,400 cash on february 2 for three months' rent for office space. tip: for convenience, simply record the full amount of the payment as an asset (prepaid rent). at the end of the month, this account will be adjusted to its proper balance. c. purchased and received supplies on february 3 for $300 cash. d. signed a promissory note on february 4, payable in two years; deposited $10,000 in the company's bank account. e. on february 5, paid cash to buy equipment for $2,500 and land for $7,500. f. placed an advertisement in the local paper on february 6 for $425 cash. g. recorded sales on february 7 totaling $1,800; $1,525 was in cash and the rest on accounts receivable. h. collected accounts receivable of $50 from customers on february 8. i. on february 9, repaired one of the computers for $120 cash. tip: most repairs involve costs that do not provide additional future economic benefits. j. incurred and paid employee wages on february 28 of $420.required: set up appropriate t-accounts for cash, accounts receivable, supplies, prepaid rent, equipment, furniture and fixtures, notes payable, contributed capital, service revenue, advertising expense, wages expense, and repair expense. all accounts begin with zero balances.tip: when preparing the t-accounts, you might find it useful to group them by type: assets, liabilities, stockholders’ equity, revenues, and expenses.2. record in t-accounts the effects of each transaction in february, referencing each transaction in the accounts with the transaction letter. show the unadjusted ending balances in the t-accounts. 3. prepare an unadjusted trial balance at the end of february.4. refer to the revenues and expenses shown on the unadjusted trial balance. based on this information, write a short memo offering your opinion on the results of operations during the first month of business.

Answers: 1

Business, 22.06.2019 00:30

Salty sensations snacks company manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. the company has budgeted the following costs for the upcoming period: 1 factory depreciation $33,782.00 2 indirect labor 84,456.00 3 factory electricity 8,446.00 4 indirect materials 40,356.00 5 selling expenses 26,900.00 6 administrative expenses 17,200.00 7 total costs $211,140.00 factory overhead is allocated to the three products on the basis of processing hours. the products had the following production budget and processing hours per case: budgeted volume (cases) processing hours per case tortilla chips 3,600 0.25 potato chips 5,300 0.11 pretzels 2,300 0.49 total 11,200 required: a. determine the single plantwide factory overhead rate.* b. use the factory overhead rate in (a) to determine the amount of total and per-case factory overhead allocated to each of the three products under generally accepted accounting principles. refer to the amount descriptions list provided for the exact wording of the answer choices for text entries.* * if required, round your answers to the nearest cen

Answers: 1

Business, 22.06.2019 07:50

The questions of economics address which of the following ? check all that apply

Answers: 3

Business, 22.06.2019 13:30

You operate a small advertising agency. you employ two secretaries, a graphic designer, three sales representatives, and an office coordinator. 1. what types of things would you consider when determining how to compensate each position? describe two (2) considerations. 2. what type of compensation plan would you use for each position?

Answers: 1

You know the right answer?

Mini corporation factored, with recourse, $600,000 of accounts receivable with huskie financing. the...

Questions

Arts, 18.09.2019 15:30

Mathematics, 18.09.2019 15:30

English, 18.09.2019 15:30

Mathematics, 18.09.2019 15:30

Advanced Placement (AP), 18.09.2019 15:30

Mathematics, 18.09.2019 15:30

History, 18.09.2019 15:30

Biology, 18.09.2019 15:30

Biology, 18.09.2019 15:30

History, 18.09.2019 15:30

Mathematics, 18.09.2019 15:30

Mathematics, 18.09.2019 15:30