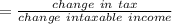

Arlene is single and has taxable income of $18,000. her tax liability is currently $2,236. she has the opportunity to earn an additional $5,000 if she accepts and completes a special project at work. there are no additional expenses to offset the $5,000 income. consequently, arlene will have a tax liability of $2,986 if she accepts the special project. arlene has a marginal tax rate of

Answers: 2

Another question on Business

Business, 21.06.2019 15:30

Josie, an unmarried taxpayer, has $155,000 in salary, $10,000 in income from a passive investment in a limited partnership, and a $26,000 passive loss from a real estate rental activity in which she actively participates. if her modified adjusted gross income is $155,000, how much of the $26,000 loss is deductible

Answers: 1

Business, 22.06.2019 16:00

Three pounds of material a are required for each unit produced. the company has a policy of maintaining a stock of material a on hand at the end of each quarter equal to 30% of the next quarter's production needs for material a. a total of 35,000 pounds of material a are on hand to start the year. budgeted purchases of material a for the second quarter would be:

Answers: 1

Business, 22.06.2019 17:30

Gary lives in an area that receives high rainfall and thunderstorms throughout the year. which device would be useful to him to maintain his computer?

Answers: 2

You know the right answer?

Arlene is single and has taxable income of $18,000. her tax liability is currently $2,236. she has t...

Questions

History, 20.11.2019 07:31

Mathematics, 20.11.2019 07:31

Mathematics, 20.11.2019 07:31

English, 20.11.2019 07:31

History, 20.11.2019 07:31

Mathematics, 20.11.2019 07:31

Biology, 20.11.2019 07:31

Mathematics, 20.11.2019 07:31

Health, 20.11.2019 07:31