Business, 08.11.2019 07:31 hardwick744

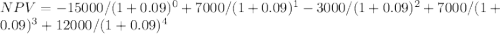

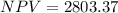

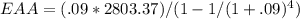

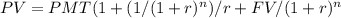

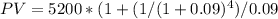

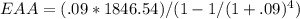

Carlyle inc. is considering two mutually exclusive projects. both require an initial investment of $15,000 at t = 0. project s has an expected life of 2 years with after-tax cash inflows of $7,000 and $12,000 at the end of years 1 and 2, respectively. in addition, project s can be repeated at the end of year 2 with no changes in its cash flows. project l has an expected life of 4 years with after-tax cash inflows of $5,200 at the end of each of the next 4 years. each project has a wacc of 9.00%. what is the equivalent annual annuity of the most profitable project? a. $ 569.97b. $ 782.34c. $ 865.31d. $1,522.18e. $1,846.54

Answers: 1

Another question on Business

Business, 22.06.2019 10:10

Rats that received electric shocks were unlikely to develop ulcers if the

Answers: 1

Business, 22.06.2019 20:40

Consider an economy where the government's budget is initially balanced. the production function, consumption function and investment function can be represented as follows y equals k to the power of alpha l to the power of 1 minus alpha end exponent c equals c subscript 0 plus b left parenthesis y minus t right parenthesis i equals i subscript 0 minus d r suppose that taxes increase. what happens to the equilibrium level of output?

Answers: 1

Business, 22.06.2019 22:00

Which of the following is the term for something that you can't live without 1. need 2. want 3. good 4. service

Answers: 1

Business, 23.06.2019 00:30

What level of measurement (nominal, ordinal, interval, ratio) is appropriate for the movie rating system that you see in tv guide?

Answers: 2

You know the right answer?

Carlyle inc. is considering two mutually exclusive projects. both require an initial investment of $...

Questions

Mathematics, 17.09.2019 22:10

History, 17.09.2019 22:10

Mathematics, 17.09.2019 22:10

English, 17.09.2019 22:10

History, 17.09.2019 22:10

Medicine, 17.09.2019 22:10

Chemistry, 17.09.2019 22:10

Chemistry, 17.09.2019 22:10

Mathematics, 17.09.2019 22:10

Mathematics, 17.09.2019 22:20

History, 17.09.2019 22:20