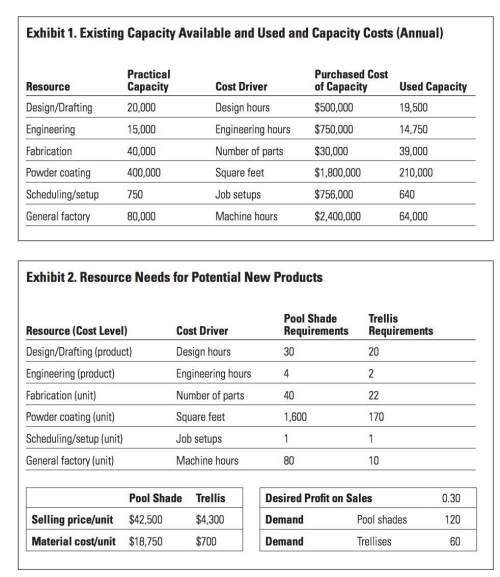

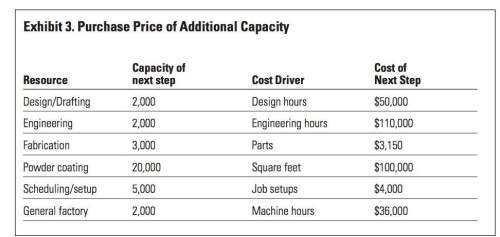

Resource spending approach: assume the decisions to make pool shades and trellises are considered to be a short-term decision and that chandler would make these products one at a time when time is available, so as not to not delay any of the custom orders. because there is excess capacity on current production equipment, the company wants to use a tactical decision (resource spending) approach to evaluate the decision to make the products. exhibit 3 provides information about the cost to purchase additional resources. a. compute the net change in cash flow of making and selling the full demand of pool shades. b. compute the net change in cash flow of making and selling the full demand of trellises. c. compute the net change in cash flow of making the full demand for both the pool shades and the trellises. d. given the assumptions aforementioned (such as short-term and excess capacity), would chandler’s management choose to make either or both of the products? explain your answer.

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Roi analysis using dupont model. charlie? s furniture store has been in business for several years. the firm? s owners have described the store as a ? high-price, highservice? operation that provides lots of assistance to its customers. margin has averaged a relatively high 32% per year for several years, but turnover has been a relatively low 0.4 based on average total assets of $800,000. a discount furniture store is about to open in the area served by charlie? s, and management is considering lowering prices in order to compete effectively. required: a. calculate current sales and roi for charlie? s furniture store. b. assuming that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same, calculate the sales that would be required to have the same roi as they currently earned. c. suppose that you presented the results of your analysis in parts a and b of this problem to charlie, and he replied, ? what

Answers: 1

Business, 21.06.2019 23:30

Actual usage for the year by the marketing department was 70,000 copies and by the operations department was 330,000 copies. if a dual-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the operations department?

Answers: 2

Business, 22.06.2019 07:50

Budget in this final week, you will develop a proposed budget of $150,000 for the first year of the program and complete the final concept paper for the proposed program due for senior management review. the budget should identify the program's anticipated expenses for the year ahead. budget line items should be consistent with the proposed program and staffing plan. using the readings for the week, the south university online library, and the internet, complete the following tasks: create a proposed budget of $150,000 for the first year of the proposed program including the cost for personnel, supplies, education materials, marketing costs, and so on in a microsoft excel spreadsheet. you may transfer your budget to your report. justify the cost for each item of the proposed budget in a budget narrative.

Answers: 2

Business, 22.06.2019 14:10

When a shortage or a surplus arises in the loanable funds market a. the supply of loanable funds changes to return the economy to its original real interest rate b. the nominal interest rate is pulled to the new equilibrium level c. the demand for loanable funds changes to return the economy to its original real interest rate d. the real interest rate is pulled to the new equilibrium level

Answers: 3

You know the right answer?

Resource spending approach: assume the decisions to make pool shades and trellises are considered t...

Questions

Mathematics, 27.03.2020 00:19

Computers and Technology, 27.03.2020 00:19

Physics, 27.03.2020 00:19

Computers and Technology, 27.03.2020 00:19

Engineering, 27.03.2020 00:19

Chemistry, 27.03.2020 00:19

Spanish, 27.03.2020 00:19