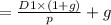

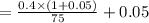

Berta industries stock has a beta of 1.25. the company just paid a dividend of $0.40, and the dividends are expected to grow at 5 percent. the expected return on the market is 12 percent, and treasury bills are yielding 5.8 percent. the most recent stock price for berta is $75. calculate the cost of equity using the dcf method.

Answers: 3

Another question on Business

Business, 22.06.2019 03:00

What is the relationship between marginal external cost, marginal social cost, and marginal private cost? a. marginal social cost equals marginal private cost plus marginal external cost. b. marginal private cost plus marginal social cost equals marginal external cost. c. marginal social cost plus marginal external cost equals marginal private cost. d. marginal external cost equals marginal private cost minus marginal social cost. marginal external cost a. is expressed in dollars, so it is not an opportunity cost b. is an opportunity cost borne by someone other than the producer c. is equal to two times the marginal private cost d. is a convenient economics concept that is not real

Answers: 3

Business, 22.06.2019 10:10

conquest, inc. produces a special kind of light-weight, recreational vehicle that has a unique design. it allows the company to follow a cost-plus pricing strategy. it has $9,000,000 of average assets, and the desired profit is a 10% return on assets. assume all products produced are sold. additional data are as follows: sales volume 1000 units per year; variable costs $1000 per unit; fixed costs $4,000,000 per year; using the cost-plus pricing approach, what should be the sales price per unit?

Answers: 2

Business, 22.06.2019 11:00

Which ranks these careers that employers are most likely to hire from the least to the greatest?

Answers: 2

Business, 22.06.2019 19:00

It is estimated that over 100,000 students will apply to the top 30 m.b.a. programs in the united states this year. a. using the concept of net present value and opportunity cost, when is it rational for an individual to pursue an m.b.a. degree. b. what would you expect to happen to the number of applicants if the starting salaries of managers with m.b.a. degrees remained constant but salaries of managers without such degrees decreased by 20 percent

Answers: 3

You know the right answer?

Berta industries stock has a beta of 1.25. the company just paid a dividend of $0.40, and the divide...

Questions

Mathematics, 16.10.2020 05:01

Mathematics, 16.10.2020 05:01

Biology, 16.10.2020 05:01

Mathematics, 16.10.2020 05:01

Geography, 16.10.2020 05:01

English, 16.10.2020 05:01

English, 16.10.2020 05:01

Biology, 16.10.2020 05:01

Social Studies, 16.10.2020 05:01