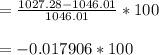

A13-year, 6 percent coupon bond pays interest semiannually. the bond has a face value of $1,000. what is the percentage change in the price of this bond if the market yield to maturity rises to 5.7 percent from the current rate of 5.5 percent? select one:

a. 1.79 percent

b. −1.79 percent

c. −1.38 percent

d. −1.64 percent

Answers: 1

Another question on Business

Business, 22.06.2019 00:40

Guardian inc. is trying to develop an asset-financing plan. the firm has $450,000 in temporary current assets and $350,000 in permanent current assets. guardian also has $550,000 in fixed assets. assume a tax rate of 40 percent. a. construct two alternative financing plans for guardian. one of the plans should be conservative, with 70 percent of assets financed by long-term sources, and the other should be aggressive, with only 56.25 percent of assets financed by long-term sources. the current interest rate is 12 percent on long-term funds and 7 percent on short-term financing. compute the annual interest payments under each plan.

Answers: 3

Business, 22.06.2019 16:30

Penelope summers received certain income benefits in 2018. she received $1,400 of state unemployment insurance benefits, $2,000 from a federal unemployment trust fund and $3,700 workers’ compensation received for an occupational injury. what amount of the compensation must penelope include in her income

Answers: 1

Business, 23.06.2019 01:00

To travelers know what to expect researchers collect the prices of commodities

Answers: 2

Business, 23.06.2019 21:00

Use the accounting equation to solve for the missing information. 2. did jacob'sjacob's overhead doors report net income or net loss?

Answers: 2

You know the right answer?

A13-year, 6 percent coupon bond pays interest semiannually. the bond has a face value of $1,000. wha...

Questions

Mathematics, 23.07.2020 19:01

Mathematics, 23.07.2020 19:01

Physics, 23.07.2020 19:01

Mathematics, 23.07.2020 19:01

Computers and Technology, 23.07.2020 19:01