Your company, which has a marr of 12%, is considering the following two investment alternatives:

- project a project b

initial capital investment $40,000 $60,000

revenues $15,000 per year, $24,000 per year

starting in year 3 starting in year 4

expenses $3,000 per year $3,000 per year

salvage value $4,000 $9,000

project life 10 years 10 years

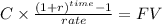

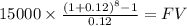

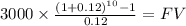

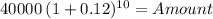

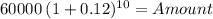

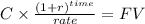

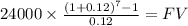

a) find the future worth of project a and project b.

b) determine which project, if any, your company should choose.

c) find the irr of project a.

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

Tina is applying for the position of a daycare assistant at a local childcare center. which document should tina send with a résumé to her potential employer? a. educational certificate b. work experience certificate c. cover letter d. follow-up letter

Answers: 1

Business, 22.06.2019 04:30

Peyton taylor drew a map with scale 1 cm to 10 miles. on his map, the distance between silver city and golden canyon is 3.75 cm. what is the actual distance between silver city and golden canyon?

Answers: 3

Business, 22.06.2019 14:10

Location test: question 1 of 54)water is a solvent because itoa. is made of moleculesob. dissolves many substancesc. is a saltd. has a large buffering capacity

Answers: 1

Business, 22.06.2019 19:00

What is an equation of the line in slope intercept formm = 4 and the y-intercept is (0,5)y = 4x-5y = -5x +4y = 4x + 5y = 5x +4

Answers: 1

You know the right answer?

Your company, which has a marr of 12%, is considering the following two investment alternatives:

Questions

Mathematics, 24.06.2019 21:00

Geography, 24.06.2019 21:00

Mathematics, 24.06.2019 21:00

History, 24.06.2019 21:00

Mathematics, 24.06.2019 21:00

Geography, 24.06.2019 21:00