Business, 16.11.2019 07:31 maddie6610

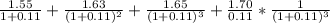

Arcs and triangles paid an annual dividend of $1.47 a share last month. the company is planning on paying $1.55, $1.63, and $1.65 a share over the next three years, respectively. after that, the dividend will be constant at $1.70 per share per year. what is the market price of this stock if the market rate of return is 11 percent?

a) $13.98

b) $14.07

c) $15.23

d) $17.16

e) $13.10

Answers: 1

Another question on Business

Business, 21.06.2019 14:30

Processors can be or which is an indicator of how much data the processors can handle at a given point in time, with the processor being more powerful.

Answers: 2

Business, 22.06.2019 07:30

An instance where sellers should work to keep relationships with customers is when they instance where selllars should work to keep relationships with customers is when they feel that the product

Answers: 1

Business, 22.06.2019 11:50

Stocks a, b, and c are similar in some respects: each has an expected return of 10% and a standard deviation of 25%. stocks a and b have returns that are independent of one another; i.e., their correlation coefficient, r, equals zero. stocks a and c have returns that are negatively correlated with one another; i.e., r is less than 0. portfolio ab is a portfolio with half of its money invested in stock a and half in stock b. portfolio ac is a portfolio with half of its money invested in stock a and half invested in stock c. which of the following statements is correct? a. portfolio ab has a standard deviation that is greater than 25%.b. portfolio ac has an expected return that is less than 10%.c. portfolio ac has a standard deviation that is less than 25%.d. portfolio ab has a standard deviation that is equal to 25%.e. portfolio ac has an expected return that is greater than 25%.

Answers: 3

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

You know the right answer?

Arcs and triangles paid an annual dividend of $1.47 a share last month. the company is planning on p...

Questions

Health, 21.11.2020 03:40

History, 21.11.2020 03:40

Health, 21.11.2020 03:40

Chemistry, 21.11.2020 03:40

Mathematics, 21.11.2020 03:40

Mathematics, 21.11.2020 03:40

Mathematics, 21.11.2020 03:40

Mathematics, 21.11.2020 03:40

Mathematics, 21.11.2020 03:40

Mathematics, 21.11.2020 03:40

Computers and Technology, 21.11.2020 03:40

Physics, 21.11.2020 03:40

English, 21.11.2020 03:40