Business, 18.11.2019 20:31 PatienceJoy

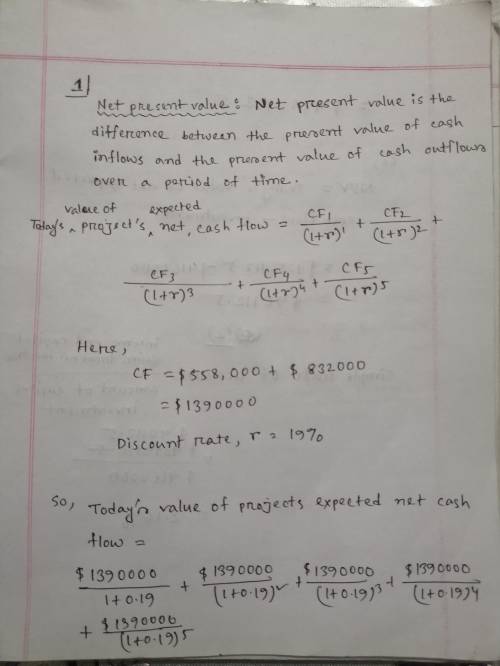

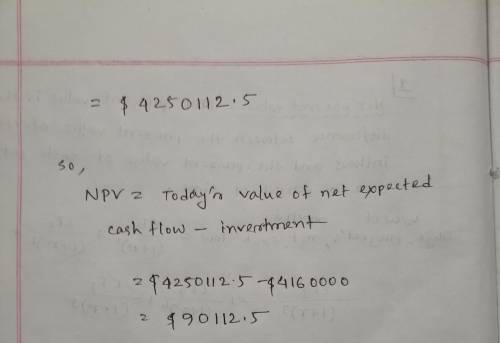

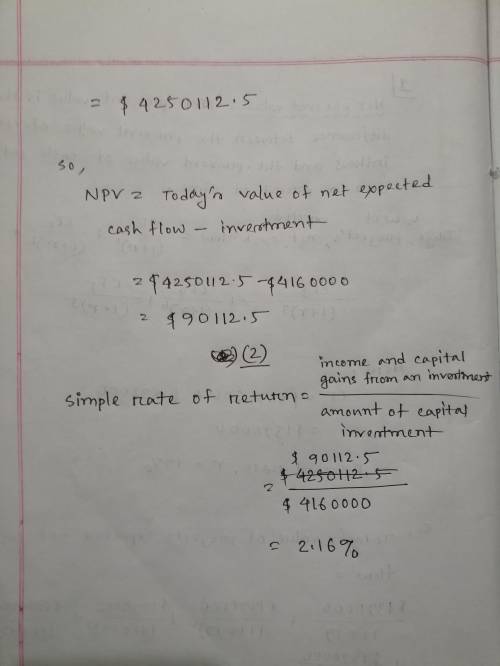

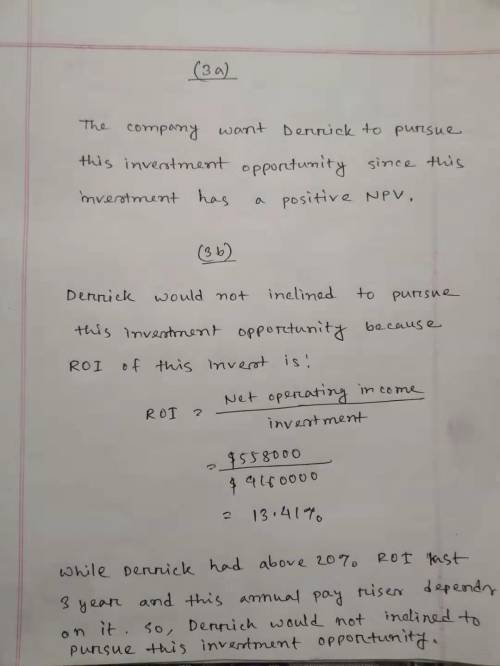

Derrick iverson is a divisional manager for holston company. his annual pay raises are largely determined by his division’s return on investment (roi), which has been above 20% each of the last three years. derrick is considering a capital budgeting project that would require a $4,160,000 investment in equipment with a useful life of five years and no salvage value. holston company’s discount rate is 19%. the project would provide net operating income each year for five years as follows: sales $ 3,700,000 variable expenses 1,600,000 contribution margin 2,100,000 fixed expenses: advertising, salaries, and other fixed out-of-pocket costs $ 710,000 depreciation 832,000 total fixed expenses 1,542,000 net operating income $ 558,000 click here to view exhibit 12b-1 and exhibit 12b-2, to determine the appropriate discount factor(s) using tables. required: 1. compute the project's net present value. 2. compute the project's simple rate of return. 3a. would the company want derrick to pursue this investment opportunity? 3b. would derrick be inclined to pursue this investment opportunity?

Answers: 1

Another question on Business

Business, 22.06.2019 10:30

Perez, inc., applies the equity method for its 25 percent investment in senior, inc. during 2018, perez sold goods with a 40 percent gross profit to senior, which sold all of these goods in 2018. how should perez report the effect of the intra-entity sale on its 2018 income statement?

Answers: 2

Business, 22.06.2019 18:50

Plastic and steel are substitutes in the production of body panels for certain automobiles. if the price of plastic increases, with other things remaining the same, we would expect: a) the demand curve for plastic to shift to the left. b) the price of steel to fall. c) the demand curve for steel to shift to the left d) nothing to happen to steel because it is only a substitute for plastic. e) the demand curve for steel to shift to the right

Answers: 3

Business, 22.06.2019 23:10

The direct labor budget of yuvwell corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st quarter 2nd quarter 3rd quarter 4th quarterbudgeted direct labor-hours 11,200 9,800 10,100 10,900the company uses direct labor-hours as its overhead allocation base. the variable portion of its predetermined manufacturing overhead rate is $6.00 per direct labor-hour and its total fixed manufacturing overhead is $80,000 per quarter. the only noncash item included in fixed manufacturing overhead is depreciation, which is $20,000 per quarter.required: 1. prepare the company’s manufacturing overhead budget for the upcoming fiscal year.2. compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.

Answers: 3

Business, 23.06.2019 03:20

Draw, label and explain the circular flow model (cfm). include the following: firms, households, product market, and factor (or resource) market.who owns the productive resources? what are those resources? what payment does each type of resource earn? explain the two markets in the cfm and explain the roles that firms and household each play in the cfm.

Answers: 2

You know the right answer?

Derrick iverson is a divisional manager for holston company. his annual pay raises are largely deter...

Questions

Mathematics, 16.04.2020 21:16

English, 16.04.2020 21:16

Mathematics, 16.04.2020 21:16

Mathematics, 16.04.2020 21:16

History, 16.04.2020 21:16

Chemistry, 16.04.2020 21:17

History, 16.04.2020 21:17

English, 16.04.2020 21:17

History, 16.04.2020 21:17

Biology, 16.04.2020 21:17