Business, 19.11.2019 23:31 juansantos7b

Tim, a single taxpayer, operates a business as a single-member llc. in 2018, his llc reports business income of $394,000 and business deductions of $689,500, resulting in a loss of $295,500. what are the implications of this business loss?

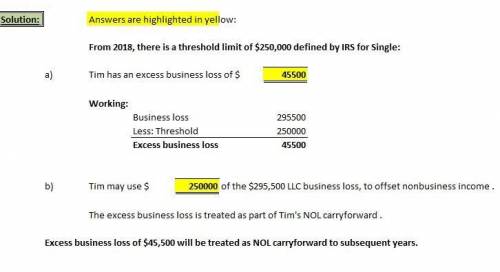

tim has an excess business loss of $

can this business loss be used to offset other income that tim reports? if so, how much? if not, what happens to the loss?

tim may use $ of the $295,500 llc business loss, to offset nonbusiness income . the excess business loss is treated as part of tim's nol carryforward .

Answers: 1

Another question on Business

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 17:30

One of your new suppliers, kim, has been hearing rumors about your firm’s lack of capability to deliver high quality products and writes an email asking you to address the claims being made. in replying to her, you want to be sure that you are very clear and leave no room for misinterpretation. which of the following aspects of effective communication should you give the most attention? (a) making sure you understand kim’s areas of expertise. (b) supporting your reply with relevant data and facts. (c) establishing your credibility as an expert. (d) paying attention to implied communications.

Answers: 2

Business, 22.06.2019 20:10

While cell phones with holographic keyboards are currently in the introduction stage of the industry life cycle, tablet computers are in the growth stage. in the context of this scenario, which of the following statements is true? a. the industry for cell phones with holographic keyboards will face greater competition than the tablet industry. b. while the industry for cell phones with holographic keyboards will focus more on product innovation, the tablet industry will focus more on process innovation. c. while the industry for cell phones with holographic keyboards can reap the benefits of economies of scale, the tablet industry will experience no such benefits. d. the industry for cell phones with holographic keyboards will face price competition, whereas, in the tablet industry, the mode of competition will be non-price.

Answers: 2

You know the right answer?

Tim, a single taxpayer, operates a business as a single-member llc. in 2018, his llc reports busines...

Questions

Mathematics, 19.08.2020 16:01

Mathematics, 19.08.2020 16:01

History, 19.08.2020 16:01

English, 19.08.2020 16:01

Mathematics, 19.08.2020 16:01

Mathematics, 19.08.2020 16:01

Chemistry, 19.08.2020 16:01

History, 19.08.2020 16:01

Mathematics, 19.08.2020 16:01

Mathematics, 19.08.2020 16:01

Mathematics, 19.08.2020 16:01

Biology, 19.08.2020 16:01

Mathematics, 19.08.2020 16:01