Business, 21.11.2019 00:31 dacanul100

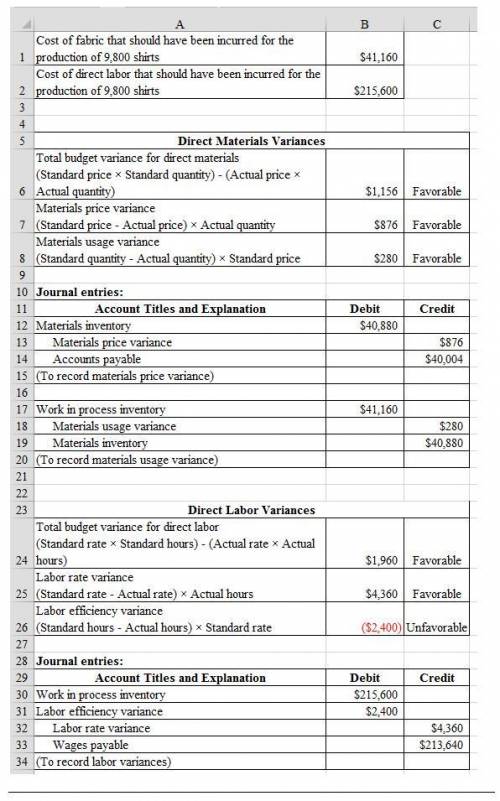

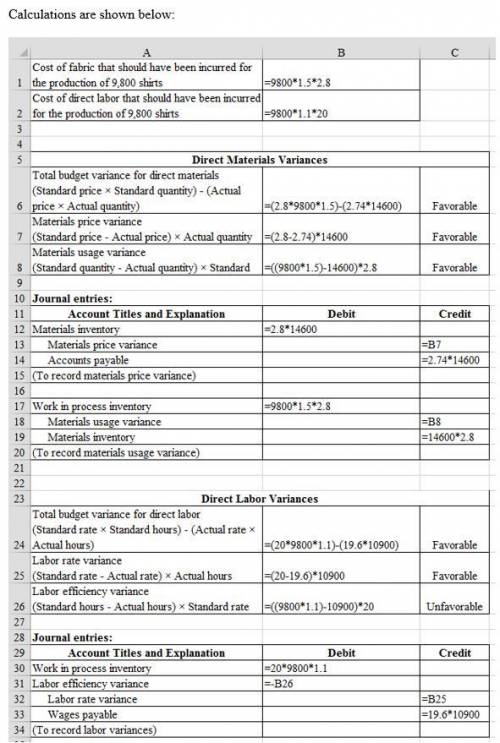

Haversham corporation produces dress shirts. the company uses a standard costing system and has set the followin standards for direct materials and direct labor (for one shirt): fabric ( 1.5 yds. at $2.80) = $4.20 direct labor (1.1 hr. at $20) = 22.00 total prime cost = $26.20 during the year, haversham produced 9,800 shirts. the actual fabric purchased was 14,600 yards at $2.74 per yard. there wer no beginnin or ending inventories of fabric. actual direct labor was 10,900 hours at $19.60 per hour. a. compute the costs of fabric and direct labor that should have been incurred for the production of 9,800 shirts b. compute the total budget variances for direct materials and direct labor. c. break down the total budget variance for direct materials into a price variance and usage variance. prepare the journal entries asscoiated with these variances. d. break down the total budget variance for direct labor into a rate variance and an efficiency variance. prepare the journal entries associated with these variances.

Answers: 1

Another question on Business

Business, 22.06.2019 05:30

Laurelton heating & cooling installs and services commercial heating and cooling systems. laurelton uses job costing to calculate the cost of its jobs. overhead is allocated to each job based on the number of direct labor hours spent on that job. at the beginning of the current year, laurelton estimated that its overhead for the coming year would be $ 61 comma 500. it also anticipated using 4 comma 100 direct labor hours for the year. in april comma laurelton started and completed the following two jobs: (click the icon to view the jobs.) laurelton paid a $ 20-per-hour wage rate to the employees who worked on these two jobs. read the requirements requirement 1. what is laurelton's predetermined overhead rate based on direct labor hours? determine the formula to calculate laurelton's predetermined overhead rate based on direct labor hours, then calculate the rate. / = predetermined overhead rate

Answers: 2

Business, 22.06.2019 11:40

Define the marginal rate of substitution between two goods (x and y). if a consumer’s preferences are given by u(x,y) = x3/4y1/4, compute the consumer’s marginal rate of substitution as a function of x and y. calculate the mrs if the consumer has chosen to consumer 48 units of x and 16 units of y. show your work. (use the back of the page if necessary.

Answers: 3

Business, 22.06.2019 14:50

Ann chovies, owner of the perfect pasta pizza parlor, uses 20 pounds of pepperoni each day in preparing pizzas. order costs for pepperoni are $10.00 per order, and carrying costs are 4 cents per pound per day. lead time for each order is three days, and the pepperoni itself costs $3.00 per pound. if she were to order 80 pounds of pepperoni at a time, what would be the average inventory level?

Answers: 3

Business, 22.06.2019 19:20

This problem has been solved! see the answerwhich of the following statements is correct? the consumer price index is a measure of the overall level of prices, whereas the gdp deflator is not a measure of the overall level of prices. if, in the year 2011, the consumer price index has a value of 123.50, then the inflation rate for 2011 must be 23.50 percent. compared to the gdp deflator, the consumer price index is the more common gauge of inflation. the consumer price index and the gdp deflator reflect the goods and services bought by consumers equally well.

Answers: 2

You know the right answer?

Haversham corporation produces dress shirts. the company uses a standard costing system and has set...

Questions

Mathematics, 31.08.2019 21:30

Mathematics, 31.08.2019 21:30

History, 31.08.2019 21:30

Mathematics, 31.08.2019 21:30

World Languages, 31.08.2019 21:30

Geography, 31.08.2019 21:30

History, 31.08.2019 21:30

Mathematics, 31.08.2019 21:30