Business, 21.11.2019 06:31 uticabadgirl

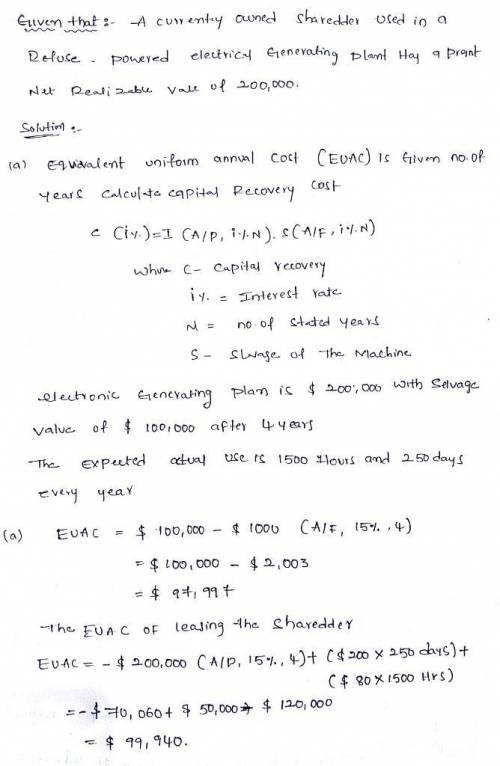

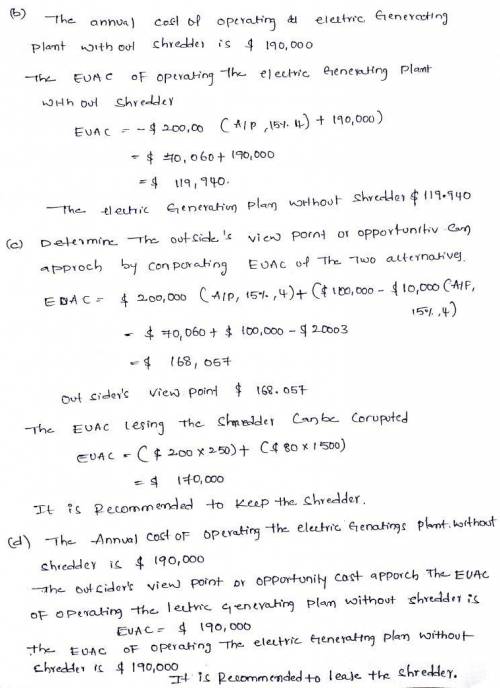

Acurrently owned shredder used in a refuse-powered electrical generating plant has a present net realizable value of $200,000 and is expected to have a market value of $10,000 after 4 years. operating and maintenance disbursements are $100,000 per year. an equivalent shredder can be leased for $200 per day plus $80 per hour of actual use as determined by an hour meter, with both components assumed to be paid at year-end. actual use is expected to be 1,500 hours and 250 days per year. using a 4-year planning horizon, a before-tax analysis, and a marr of 15%, determine the preferred alternative using the annual cost criterion.

Answers: 1

Another question on Business

Business, 23.06.2019 09:40

When providing the square footage of a property for sale, the salesperson should disclose what?

Answers: 3

Business, 23.06.2019 17:00

Justin signed a rental agreement for his condo. after he moved out, the owner determined that the condo needed to be cleaned, the cost of which totaled $150. how much of a deposit can justin expect back? (to view the contract click here.)

Answers: 3

Business, 23.06.2019 23:30

D. if you match up pairs of buyers and sellers so as to maximize the total surplus of all transactions, what is the largest total surplus that can be achieved?

Answers: 3

Business, 24.06.2019 02:30

What is measured by such benchmarks as satisfaction surveys, percentage of existing customers retained, and increases in revenue dollars per customer? usability?

Answers: 3

You know the right answer?

Acurrently owned shredder used in a refuse-powered electrical generating plant has a present net rea...

Questions

Mathematics, 30.04.2021 07:40

Mathematics, 30.04.2021 07:40

Mathematics, 30.04.2021 07:40

Mathematics, 30.04.2021 07:40

World Languages, 30.04.2021 07:40

Computers and Technology, 30.04.2021 07:40

History, 30.04.2021 07:40

Mathematics, 30.04.2021 07:40

Mathematics, 30.04.2021 07:40

English, 30.04.2021 07:40

Mathematics, 30.04.2021 07:40

Mathematics, 30.04.2021 07:40

English, 30.04.2021 07:40

Mathematics, 30.04.2021 07:40

Social Studies, 30.04.2021 07:40