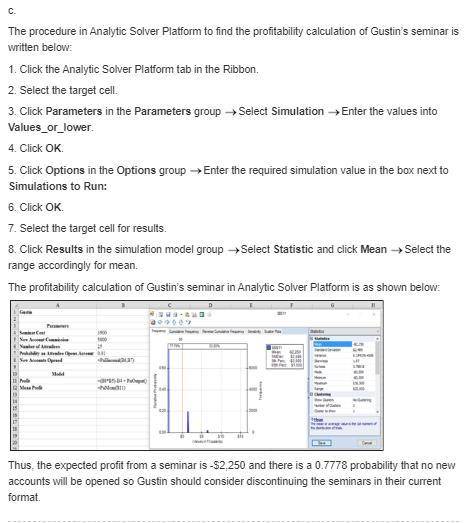

To generate leads for new business, gustin investment services offers free financial planning seminars at major hotels in southwest florida. gustin conducts seminars for groups of 25 individuals. each seminar costs gustin $3,600 and the average first-year commission for each new account opened is $5,600. gustin estimates that for each individual attending the seminar, there is a 0.01 probability that he/she will open a new account. a. determine the equation for computing gustin’s profit per seminar, given values of the relevant parameters. b. what type of random variable is the number of new accounts opened? (hint: review appendix 11.2 for descriptions of various types of probability distributions.)c. construct a spreadsheet simulation model to analyze the profitability of gustin’s seminars. would you recommend that gustin continue running the seminars? d. how large of an audience does gustin need before a seminar’s expected profit is greater than zero?

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

Side bar toggle icon performance in last 10 qs hard easy performance in last 10 questions - there are '3' correct answers, '3' wrong answers, '0' skipped answers, '1' partially correct answers about this question question difficulty difficulty 60% 42.2% students got it correct study this topic • demonstrate an understanding of sampling distributions question number q 3.8: choose the correct estimate for the standard error using the 95% rule.

Answers: 2

Business, 22.06.2019 10:50

The uptowner just paid an annual dividend of $4.12. the company has a policy of increasing the dividend by 2.5 percent annually. you would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. if you require a rate of return of 16.7 percent, how much will you be willing to pay per share when you can afford to make this investment?

Answers: 3

Business, 22.06.2019 11:30

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

Business, 22.06.2019 16:20

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

You know the right answer?

To generate leads for new business, gustin investment services offers free financial planning semina...

Questions

Mathematics, 08.07.2019 05:00

History, 08.07.2019 05:00

Mathematics, 08.07.2019 05:00

Mathematics, 08.07.2019 05:00

History, 08.07.2019 05:00

Mathematics, 08.07.2019 05:00

Mathematics, 08.07.2019 05:00

Social Studies, 08.07.2019 05:00

English, 08.07.2019 05:00

Biology, 08.07.2019 05:00