The rivoli company has no debt outstanding, and its financial position is given by the following data:

assets (book = market) 300,000

ebit 500,000,

cost of equity, rs 10%

stock price, po $15

shares outstanding, no 200,000

tax rate, t 40%

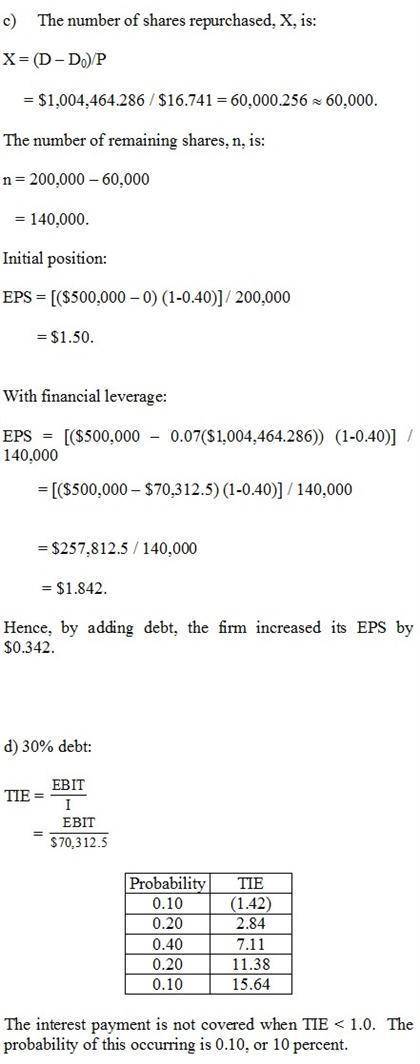

the firm is considering selling bonds and simultaneously repurchasing some of its stock. if it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 11% to reflect the increased risk. bonds can be sold at a cost rd of 7%. rivoli is a no growth firm. hence, all its earnings are paid out as dividends. earnings are expected to be constant over time.

a.) what effect would this use of leverage have on the value of the firm:

b.) what would be the price of rivoli’s stock?

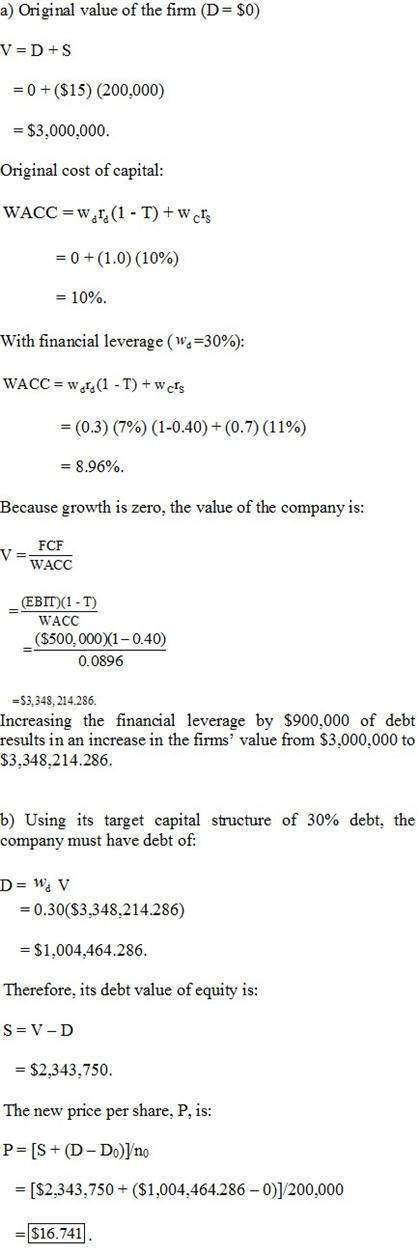

c.) what happens to the firm’s earnings per share after the recapitalization?

d.) the $500,000 ebit given previously is actually the expected value from the following probability distribution:

probability ebit

0.1 100,000

0.2 200,000

0.4 500,000

0.2 800,000

0.1 1,100,000

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

Sonic corp. manufactures ski and snowboarding equipment. it has estimated that this year there will be substantial growth in its sales during the winter months. it approaches the bank for credit. what is the purpose of such credit known as? a. expansion b. inventory building c. debt management d. emergency maintenance

Answers: 3

Business, 22.06.2019 22:50

Suppose that the u.s. dollars-mexican pesos exchange rate is fixed by the u.s. and mexican governments. assume also that labor is mobile between the united states and mexico due to low transportation costs.which of the following situations is likely to happen as a result of a simultaneous increase in the demand for u.s. goods and decrease in the demand for mexican goods? (pick mexican unemployment rate increases, and the country undergoes bad economic times for a sustained u.s. unemployment rate increases, and the country undergoes bad economic times for a sustained mexican unemployment rate rises at first, but it soon drops as unemployed mexicans move to the united states for mexican unemployment rate rises at first, but then it drops as mexican pesos depreciate against u.s. dollars.

Answers: 1

Business, 23.06.2019 07:00

Which of the following are direct employee sources of foodborne disease organisms? a) normal flora b) sick employees c) transient microorganisms d) all of the above

Answers: 1

Business, 23.06.2019 10:00

In two or three sentences describe how open market operations change the money suppy

Answers: 3

You know the right answer?

The rivoli company has no debt outstanding, and its financial position is given by the following dat...

Questions

Biology, 21.05.2020 20:04

Mathematics, 21.05.2020 20:04

Mathematics, 21.05.2020 20:04

History, 21.05.2020 20:04

Mathematics, 21.05.2020 20:04

Mathematics, 21.05.2020 20:04

Mathematics, 21.05.2020 20:04

Mathematics, 21.05.2020 20:04

Mathematics, 21.05.2020 20:04

History, 21.05.2020 20:04

English, 21.05.2020 20:04

History, 21.05.2020 20:04

History, 21.05.2020 20:04

Social Studies, 21.05.2020 20:04