Business, 22.11.2019 00:31 Alysssssssssssa

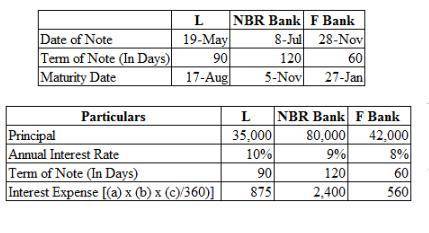

Purchased $40,250 of merchandise on credit from locust, terms n/30. tyrell uses the perpetual inventory system. may 19 replaced the april 20 account payable to locust with a 90-day, $35,000 note bearing 10% annual interest along with paying $5,250 in cash. july 8 borrowed $80,000 cash from nbr bank by signing a 120-day, 9% interest-bearing note with a face value of $80,000. paid the amount due on the note to locust at the maturity date. paid the amount due on the note to nbr bank at the maturity date. nov. 28 borrowed $42,000 cash from fargo bank by signing a 60-day, 8% interest-bearing note with a face value of $42,000. dec. 31 recorded an adjusting entry for accrued interest on the note to fargo bank.

Answers: 1

Another question on Business

Business, 22.06.2019 04:00

Wallis company manufactures only one product and uses a standard cost system. the company uses a predetermined plantwide overhead rate that relies on direct labor-hours as the allocation base. all of the company's manufacturing overhead costs are fixed—it does not incur any variable manufacturing overhead costs. the predetermined overhead rate is based on a cost formula that estimated $2,886,000 of fixed manufacturing overhead for an estimated allocation base of 288,600 direct labor-hours. wallis does not maintain any beginning or ending work in process inventory.

Answers: 2

Business, 22.06.2019 13:30

The purpose of safety stock is to: a. eliminate the possibility of a stockout. b. control the likelihood of a stockout due to variable demand and/or lead time. c. eliminate the likelihood of a stockout due to erroneous inventory tally. d. protect the firm from a sudden decrease in demand. e. replace failed units with good ones.

Answers: 1

Business, 22.06.2019 16:30

Bernard made a gift of $500,000 to his brother in 2014. due to bernard’s prior taxable gifts he paid $200,000 of gift tax. when bernard died in 2019, the applicable gift tax credit had increased. at bernard’s death, what amount related to the $500,000 gift to his brother is included in his gross estate?

Answers: 3

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

You know the right answer?

Purchased $40,250 of merchandise on credit from locust, terms n/30. tyrell uses the perpetual invent...

Questions

Spanish, 09.06.2021 03:20

Mathematics, 09.06.2021 03:20

Mathematics, 09.06.2021 03:20

English, 09.06.2021 03:20

Mathematics, 09.06.2021 03:20

Mathematics, 09.06.2021 03:20

World Languages, 09.06.2021 03:20

Spanish, 09.06.2021 03:20