The following information is provided by the town of york's general fund operating statement and budgetary accounts for the fiscal year ened september 30, 2016. (note: the town has no restricted, commited, or assigned fund balances.)

estimated revenues-32,150,000

revenues - 32,190,000

apporations - 32,175,000

expenditures - 32,185,000

fund balance - unassigned septtember 30,2015 - 500,000

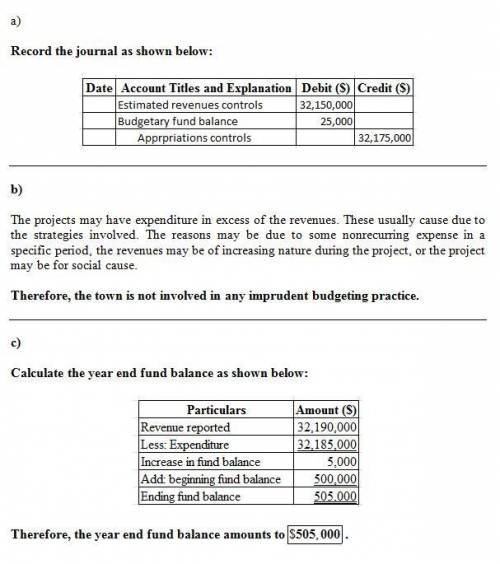

a. prepare a journal entry to record the budget

b. did the town of york engage in imprudent budgeting practice by authorizing a greater amount of expenditures than revenues estimated for the year, or potentially violate town or state balanced-budget laws.

c. calculate the end of year balance for the fund balance- unassigned that would be reported on the town's balance sheet prepared as of september 30,2016. show all work necessary work.

Answers: 1

Another question on Business

Business, 21.06.2019 19:20

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense. accounts receivable $ 435,000 debit allowance for doubtful accounts 1,250 debit net sales 2,100,000 credit all sales are made on credit. based on past experience, the company estimates 1.0% of credit sales to be uncollectible. what adjusting entry should the company make at the end of the current year to record its estimated bad debts expense

Answers: 2

Business, 21.06.2019 21:20

Vital industries manufactured 2 comma 200 units of its product huge in the month of april. it incurred a total cost of $ 121 comma 000 during the month. out of this $ 121 comma 000, $ 46 comma 000 comprised of direct materials used in the product and the rest was incurred because of the conversion cost involved in the process. ryan had no opening or closing inventory. what will be the total cost per unit of the product, assuming conversion costs contained $ 10 comma 900 of indirect labor?

Answers: 1

Business, 21.06.2019 21:30

The beach dude (bd) employs a legion of current and former surfers as salespeople who push its surfing-oriented products to various customers (usually retail outlets). this case describes bd's sales and collection process. each bd salesperson works with a specific group of customers throughout the year. in fact, they often surf with their customers to try out the latest surf gear. the bd salespeople act laid-back, but they work hard for their sales. each sale often involves hours of surfing with their customers while the customers sample all the latest surf wear. because bd makes the best surfing products, the customers look forward to the visits from the bd salespeople. and they often buy a lot of gear. each sale is identified by a unique invoice number and usually involves many different products. customers pay for each sale in full within 30 days, but they can combine payments for multiple sales. bd manages its clothing inventory by item (e.g., xl bd surfer logo t-shirts), identified by product number, but it also classifies the items by clothing line (the lines are differentiated by price points as well as the intended use of the clothing, e.g., surfing products, casual wear, . draw a uml class diagram that describes the beach dudes sales and collection process.b. using microsoft access, implement a relational database from your uml class diagram. identify at least three fields per table.c. describe how you would use the relational database to determine the beach dude’s accounts receivable.

Answers: 3

Business, 22.06.2019 13:10

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

You know the right answer?

The following information is provided by the town of york's general fund operating statement and bud...

Questions

Mathematics, 13.12.2020 05:10

History, 13.12.2020 05:20

History, 13.12.2020 05:20

Mathematics, 13.12.2020 05:20

Mathematics, 13.12.2020 05:20

History, 13.12.2020 05:20

Mathematics, 13.12.2020 05:20

History, 13.12.2020 05:20

Social Studies, 13.12.2020 05:20

Biology, 13.12.2020 05:20

Mathematics, 13.12.2020 05:20

Biology, 13.12.2020 05:20