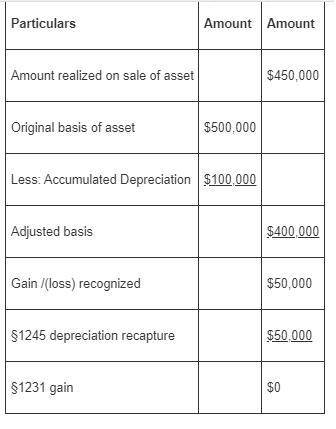

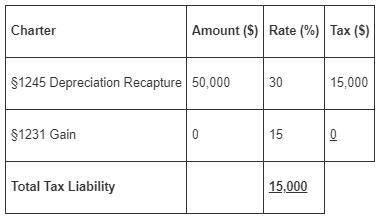

Hart, an individual, bought an asset for $500,000 and has claimed $100,000 of depreciation deductions against the asset. hart has a marginal tax rate of 32 percent. answer the questions presented in the following alternative scenarios (assume hart had no property transactions other than those described in the problem): (loss amounts should be indicated by a minus sign. enter na if a situation is not applicable. leave no answer blank. enter zero if applicable.) required: a1. what is the amount and character of hart’s recognized gain or loss if the asset is tangible personal property sold for $450,000? a2. due to this sale, what tax effect does hart have for the year?

Answers: 3

Another question on Business

Business, 22.06.2019 08:30

What is the key to success in integrating both lethal and nonlethal activities during planning? including stakeholders once a comprehensive operational approach has been determined knowing the commander's decision making processes and "touch points" including stakeholders from the very beginning of the design and planning process including the liaison officers (lnos) in all the decision points?

Answers: 1

Business, 22.06.2019 13:10

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

Business, 22.06.2019 19:00

When making broccoli cream soup, the broccoli and aromatics should be a. burned. b. simmered. c. puréed. d. sweated.

Answers: 2

Business, 22.06.2019 20:50

Stormie zanzibar owns a bakery in the fictitious country of olombia. each month the government’s market ministry mails her a large list of the regulated price of goods which include products like bread, muffins and flat bread. the list also dictates the types of goods she can sell at the bakery and what she is to charge. because of the regulations placed on these goods, stormie has increased her production of sweets, pies, cakes, croissants and buns and decreased her supply of breads, muffins and flat bread. she has taken these steps because the sweet goods’ prices are not government controlled. stormie zanzibar lives under what type of economy?

Answers: 3

You know the right answer?

Hart, an individual, bought an asset for $500,000 and has claimed $100,000 of depreciation deduction...

Questions

Mathematics, 10.10.2019 14:30

English, 10.10.2019 14:30

Mathematics, 10.10.2019 14:30

Mathematics, 10.10.2019 14:30

Social Studies, 10.10.2019 14:30

Biology, 10.10.2019 14:30

Mathematics, 10.10.2019 14:30

Mathematics, 10.10.2019 14:30

History, 10.10.2019 14:30

Biology, 10.10.2019 14:30

History, 10.10.2019 14:30

Chemistry, 10.10.2019 14:30