Business, 22.11.2019 21:31 bevanscory123

Whether candidate 1 or candidate 2 is elected depends on the votes of two citizens. the economy may be in one of two states, a or b. the citizens agree that candidate 1 is best if the state is a and candidate 2 is best if the state is b. each citizen's preferences are represented by the expected value of a bernoulli payoff function that assigns a payoff of 1 if the best candidate for the state wins (obtains more votes than the other candidate), a payoff of 0 if the other candidate wins, and payoff of 1/2 if the candidates tie. citizen 1 is informed of the state, whereas citizen 2 believes it is a with probability 0.9 and b with probability 0.1 each citizen may either vote for candidate 1, vote for candidate 2, or not vote.

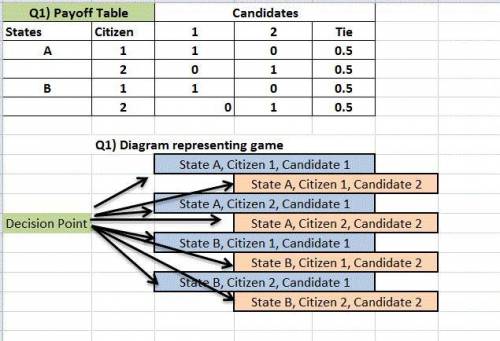

a. construct the table of payoffs for each state of the world and draw the rectangles to get a diagram that represents this game (each player has three actions: vote for candidate 1, vote for candidate 2, or abstain).

b. show that the game has exactly two pure strategy bayesian nash equilibria, in one of which citizen 2 does not vote and in the other she votes for 1.

c. why is "swing voter's curse" an appropriate name for the determinant of citizen 2's decision in the equilibrium where he abstains?

Answers: 1

Another question on Business

Business, 22.06.2019 07:00

Amarket that consists of all possible consumers regardless of their specific needs or wants is a

Answers: 1

Business, 22.06.2019 11:30

Which of the following is not an example of one of the four mail advantages of prices on a free market economy

Answers: 1

Business, 22.06.2019 19:50

Which of the following would create the most money? the initial deposit is $6,500 and the required reserve ratio is 20 percent. the initial deposit is $3,000 and the required reserve ratio is 10 percent. the initial deposit is $7,500 and the required reserve ratio is 25 percent. the initial deposit is $4,500 and the required reserve ratio is 15 percent.

Answers: 1

Business, 22.06.2019 22:40

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. use the irr decision to evaluate this project; should it be accepted or rejected

Answers: 3

You know the right answer?

Whether candidate 1 or candidate 2 is elected depends on the votes of two citizens. the economy may...

Questions

Social Studies, 05.10.2019 06:40

History, 05.10.2019 06:50

Mathematics, 05.10.2019 06:50

Computers and Technology, 05.10.2019 06:50

Biology, 05.10.2019 06:50

History, 05.10.2019 06:50

English, 05.10.2019 06:50

Mathematics, 05.10.2019 06:50

Geography, 05.10.2019 06:50

Physics, 05.10.2019 06:50