Business, 23.11.2019 00:31 becerrarboyv9mf

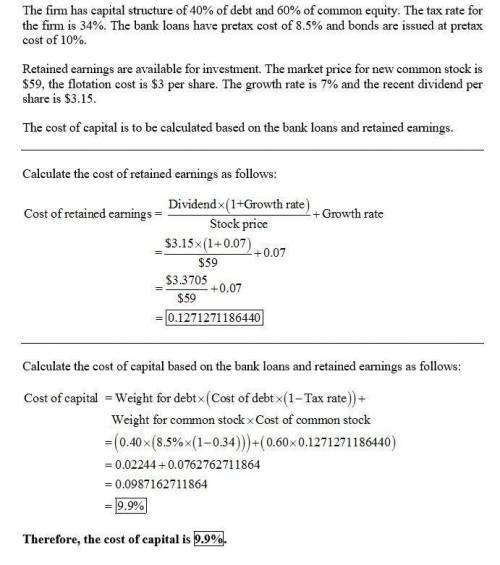

Southern corporation has a capital structure of 40% debt and 60% common equity. this capital structure is expected not to change. the firm's tax rate is 34%. the firm can issue the following securities to finance capital investments: debt: capital can be raised through bank loans at a pretax cost of 8.5%. also, bonds can be issued at a pretax cost of 10%. common stock: retained earnings will be available for investment. in addition, new common stock can be issued at the market price of $59. flotation costs will be $3 per share. the recent common stock dividend was $3.15. dividends are expected to grow at 7% in the future. what is the cost of capital if the firm uses bonds and issues new common stock?

a. 9.9%

b. 10.3%

c. 12.6%

d. 11.8%

e. 10.4%

Answers: 1

Another question on Business

Business, 21.06.2019 22:20

If you offer up your car as a demonstration that you will pay off your loan to a bank or another financial lending institution, you are using your car as collateral. true false

Answers: 2

Business, 22.06.2019 00:00

Which of the following is a disadvantage to choosing a sole proprietorship business structure? question 9 options: the owner has personal responsibility for the company's liabilities. the owner has to share the profits with partners. the owner is still liable for personal debts. the owner has to report to shareholders.

Answers: 1

Business, 22.06.2019 16:20

Stosch company's balance sheet reported assets of $112,000, liabilities of $29,000 and common stock of $26,000 as of december 31, year 1. if retained earnings on the balance sheet as of december 31, year 2, amount to $74,000 and stosch paid a $28,000 dividend during year 2, then the amount of net income for year 2 was which of the following? a)$23,000 b) $35,000 c) $12,000 d)$42,000

Answers: 1

Business, 22.06.2019 21:10

Which of the following statements is (are) true? i. free entry to a perfectly competitive industry results in the industry's firms earning zero economic profit in the long run, except for the most efficient producers, who may earn economic rent. ii. in a perfectly competitive market, long-run equilibrium is characterized by lmc < p < latc. iii. if a competitive industry is in long-run equilibrium, a decrease in demand causes firms to earn negative profit because the market price will fall below average total cost.

Answers: 3

You know the right answer?

Southern corporation has a capital structure of 40% debt and 60% common equity. this capital structu...

Questions

Mathematics, 24.04.2021 20:00

Mathematics, 24.04.2021 20:00

Mathematics, 24.04.2021 20:00

Physics, 24.04.2021 20:00

Mathematics, 24.04.2021 20:00

Social Studies, 24.04.2021 20:00

Mathematics, 24.04.2021 20:00

Mathematics, 24.04.2021 20:00

Mathematics, 24.04.2021 20:00

Computers and Technology, 24.04.2021 20:00

Physics, 24.04.2021 20:00