Business, 23.11.2019 00:31 michellen2020

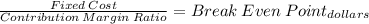

Midlands inc. had a bad year in 2016. for the first time in its history, it operated at a loss. the company’s income statement showed the following results from selling 77,000 units of product: net sales $2,310,000; total costs and expenses $1,944,000; and net loss $366,000. costs and expenses consisted of the following. total variable fixed cost of goods sold $1,275,000 $774,000 $501,000 selling expenses 520,000 94,000 426,000 administrative expenses 149,000 56,000 93,000 $1,944,000 $924,000 $1,020,000 management is considering the following independent alternatives for 2017. 1. increase unit selling price 25% with no change in costs and expenses. 2. change the compensation of salespersons from fixed annual salaries totaling $197,000 to total salaries of $40,000 plus a 5% commission on net sales. 3. purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50: 50. (a) compute the break-even point in dollars for 2016. (round contribution margin ratio to 2 decimal places e. g. 0.25 and final answer to 0 decimal places, e. g. 2,510.) break-even point $ (b) compute the break-even point in dollars under each of the alternative courses of action for 2017. (round contribution margin ratio to 4 decimal places e. g. 0.2512 and final answers to 0 decimal places, e. g. 2,510.)

Answers: 3

Another question on Business

Business, 21.06.2019 22:20

Amachine purchased three years ago for $720,000 has a current book value using straight-line depreciation of $400,000: its operating expenses are $60,000 per year. a replacement machine would cost $480,000, have a useful life of nine years, and would require $26,000 per year in operating expenses. it has an expected salvage value of $130,000 after nine years. the current disposal value of the old machine is $170,000: if it is kept 9 more years, its residual value would be $20,000. calculate the total costs in keeping the old machine and purchase a new machine. should the old machine be replaced?

Answers: 2

Business, 22.06.2019 09:00

Brian has been working for a few years now and has saved a substantial amount of money. he now wants to invest 50 percent of his savings in a bank account where it will be locked for three years and gain interest. which type of bank account should brian open? a. savings account b. money market account c. checking account d. certificate of deposit

Answers: 1

Business, 22.06.2019 16:40

Job 456 was recently completed. the following data have been recorded on its job cost sheet: direct materials $ 2,418 direct labor-hours 74 labor-hours direct labor wage rate $ 13 per labor-hour machine-hours 137 machine-hours the corporation applies manufacturing overhead on the basis of machine-hours. the predetermined overhead rate is $14 per machine-hour. the total cost that would be recorded on the job cost sheet for job 456 would be: multiple choice $3,380 $5,298 $6,138 $2,622

Answers: 1

Business, 23.06.2019 02:00

You are considering the purchase of one of two machines used in your manufacturing plant. machine 1 has a life of two years, costs $20,000 initially, and then $4,000 per year in maintenance costs. machine 2 costs $25,000 initially, has a life of three years, and requires $3,500 in annual maintenance costs. either machine must be replaced at the end of its life with an equivalent machine. using eac which is the better machine for the firm

Answers: 1

You know the right answer?

Midlands inc. had a bad year in 2016. for the first time in its history, it operated at a loss. the...

Questions

Biology, 30.06.2019 11:00

Mathematics, 30.06.2019 11:00

History, 30.06.2019 11:00

History, 30.06.2019 11:00

Biology, 30.06.2019 11:00

Mathematics, 30.06.2019 11:00

Mathematics, 30.06.2019 11:00

Mathematics, 30.06.2019 11:00

Mathematics, 30.06.2019 11:00

Mathematics, 30.06.2019 11:00

Chemistry, 30.06.2019 11:00