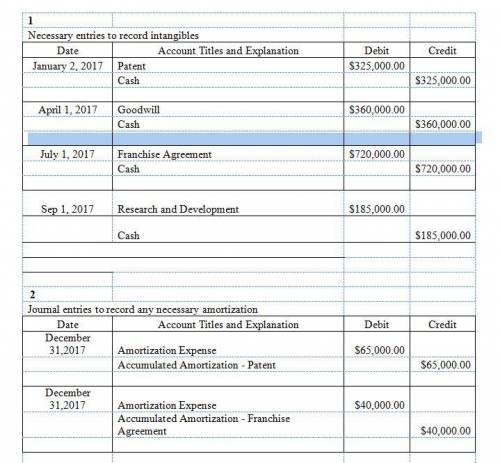

Nelson company, organized in 2017, has these transactions related to intangible assets in that year: jan. 2 purchased a patent (5-year life) $325,000. apr. 1 goodwill purchased (indefinite life) $360,000. july 1 acquired a 9-year franchise; expiration date july 1, 2026, $720,000. sept. 1 research and development costs $185,000.

1. prepare the necessary entries to record these intangibles. all costs were for cash.

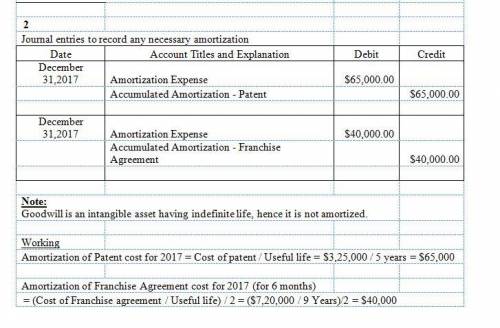

2. make the entries as of december 31, 2017, recording any necessary amortization.

Answers: 1

Another question on Business

Business, 22.06.2019 11:30

1. regarding general guidelines for the preparation of successful soups, which of the following statements is true? a. thick soups made with starchy vegetables may thin during storage. b. soups should be seasoned throughout the cooking process. c. finish a cream soup well before serving it to moderate the flavor. d. consommés take quite a long time to cool. student c incorrect

Answers: 2

Business, 22.06.2019 12:00

Identify at least 3 body language messages that project a positive attitude

Answers: 2

Business, 22.06.2019 15:00

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

Business, 22.06.2019 18:00

Martha entered into a contract with terry, an art dealer. according to the contract, terry was to supply 18 th century artifacts to martha for the play she was directing, and martha was ready to pay $50,000 for this. another director needed the same artifacts and was ready to pay $60,000. terry decided not to sell the artifacts to martha. in this case, the court may order terry to:

Answers: 2

You know the right answer?

Nelson company, organized in 2017, has these transactions related to intangible assets in that year:...

Questions

English, 19.03.2020 20:11

Computers and Technology, 19.03.2020 20:11

Biology, 19.03.2020 20:11

Mathematics, 19.03.2020 20:11

Mathematics, 19.03.2020 20:11

History, 19.03.2020 20:12

Mathematics, 19.03.2020 20:12

Mathematics, 19.03.2020 20:13