Business, 23.11.2019 01:31 lilmamagodchild123

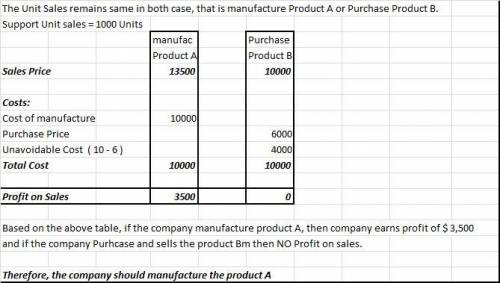

Kando company incurs a $11.00 per unit cost for product a, which it currently manufactures and sells for $13.50 per unit. instead of manufacturing and selling this product, the company can purchase it for $6.00 per unit and sell it for $11.30 per unit. if it does so, unit sales would remain unchanged and $6.00 of the $11.00 per unit costs of product a would be eliminated.

1. prepare incremental cost analysis. should the company continue to manufacture product a or purchase it for resale? (round your answers to 2 decimal places.)

in the format below:

manufacture a purchase product b

sales

costs

aviodable cost

unavoidable costs

cost to purchase

totals costs

sales

the company

Answers: 3

Another question on Business

Business, 21.06.2019 18:30

2. high-glow currently produces 1,000 bicycles per month. the following per unit data apply for sales to regular customers: direct materials $50 direct manufacturing labor 5 variable manufacturing overhead 14 fixed manufacturing overhead 10 total manufacturing costs $79 the plant is experiencing demand shortage and is considering reducing production to 800 bicycles. what is the per unit cost of producing 800 bicycles? a) $79 per unit b) $81.50 per unit c) $74 per unit d) $69 per unit

Answers: 2

Business, 22.06.2019 07:30

Select the correct answer the smith family adopted a child. the adoption procedure took about three months, and the family incurred various expenses. will the smiths receive and financial benefit for the taxable year? a) they will not receive any financial benefit for adopting the child b) their income tax component will decrease c) they will receive childcare grants d) they will receive a tax credit for the cost borne for adopting the child e) they will receive several tax deductions

Answers: 3

Business, 22.06.2019 08:10

The sec has historically raised questions regarding the independence of firms that derive a significant portion of their total revenues from one audit client or group of clients because the sec staff believes this situation causes cpa firms to

Answers: 3

Business, 22.06.2019 12:00

Suppose there are three types of consumers who attend concerts at your university’s performing arts center: students, staff, and faculty. each of these groups has a different willingness to pay for tickets; within each group, willingness to pay is identical. there is a fixed cost of $1,000 to put on a concert, but there are essentially no variable costs. for each concert: i. there are 140 students willing to pay $20. (ii) there are 200 staff members willing to pay $35. (iii) there are 100 faculty members willing to pay $50. a) if the performing arts center can charge only one price, what price should it charge? what are profits at this price? b) if the performing arts center can price discriminate and charge two prices, one for students and another for faculty/staff, what are its profits? c) if the performing arts center can perfectly price discriminate and charge students, staff, and faculty three separate prices, what are its profits?

Answers: 1

You know the right answer?

Kando company incurs a $11.00 per unit cost for product a, which it currently manufactures and sells...

Questions

Social Studies, 27.09.2019 11:00

History, 27.09.2019 11:00

English, 27.09.2019 11:00

Mathematics, 27.09.2019 11:00

English, 27.09.2019 11:00

Biology, 27.09.2019 11:00

Social Studies, 27.09.2019 11:00

Mathematics, 27.09.2019 11:00

Biology, 27.09.2019 11:10

Chemistry, 27.09.2019 11:10