Business, 24.11.2019 22:31 kyramillerr8639

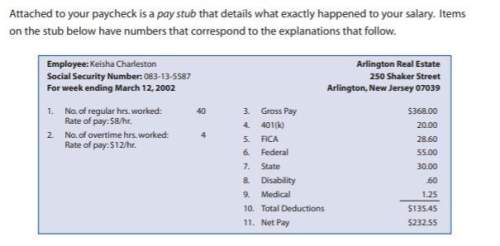

1. a standard work week is 40 hours. employers must pay the agreed-upon hourly rate of pay for these hours. here, 40 hours x $8/hr. = 320.00

2. employers usually pay one-and-a-half time the standard hourly rate for any hours over 40 that are worked. half of $8 is $4 so the overtime rate is $8+4$=$12. keisha's overtime pay is 4 hours x $12/hr. = 48.00

3. gross pay is total earnings (standard and overtime) before taxes and deductions. gross pay in the case is $320.00 + $48.00 = $368.00

4. 401(k) is a retirement account contribution that is tax-free until your retire. for the year 2003, individuals 50 years or older can contribute up to a maximum of 13,000 to this fund annually. individuals under the age for 50 can contribute up to 12,000

5. fica stands for federal insurance contribution act. this is the money that is deducted and put into your social security fund. your social security fund holds a percentage of your earnings averaged over most of your working lifetime. social security was never intended to be your only source of income when you retire or become disabled, or your family's only income if you die. it is intended to supplement other income you have from pension plans, saving investments, etc. currently, each one of your paychecks will be reduced by 7.65% specifically for your fica contribution. your employer is required by law to match this same amounr and pay it to social security

Answers: 1

Another question on Business

Business, 22.06.2019 02:10

Materials purchases (on credit). direct materials used in production. direct labor paid and assigned to work in process inventory. indirect labor paid and assigned to factory overhead. overhead costs applied to work in process inventory. actual overhead costs incurred, including indirect materials. (factory rent and utilities are paid in cash.) transfer of jobs 306 and 307 to finished goods inventory. cost of goods sold for job 306. revenue from the sale of job 306. assignment of any underapplied or overapplied overhead to the cost of goods sold account. (the amount is not material.) 2. prepare journal entries for the month of april to record the above transactions.

Answers: 1

Business, 22.06.2019 13:30

Jose recently died with a probate estate of $900,000. he was predeceased by his wife, guadalupe, and his daughter, lucy. he has two surviving children, pete and fred. jose was also survived by eight grandchildren, pete’s three children, naomi, daniel, nick; fred’s three children, heather, chris and steve; and lucy’s two children, david and rachel. jose’s will states the following “i leave everything to my three children. if any of my children shall predecease me then i leave their share to their heirs, per stirpes.” which of the following statements is correct? (a) under jose’s will rachel will receive $150,000. (b) under jose’s will chris will receive $150,000. (c) under jose’s will nick will receive $100,000. (d) under jose’s will pete will receive $200,000.

Answers: 1

Business, 22.06.2019 13:50

The retained earnings account has a credit balance of $24,650 before closing entries are made. if total revenues for the period are $77,700, total expenses are $56,900, and dividends are $13,050, what is the ending balance in the retained earnings account after all closing entries are made?

Answers: 2

Business, 22.06.2019 19:00

All of the following led to the collapse of the soviet economy except a. a lack of worker incentives. c. inadequate supply of consumer goods. b. a reliance on production quotas. d. the introduction of a market economy.

Answers: 1

You know the right answer?

1. a standard work week is 40 hours. employers must pay the agreed-upon hourly rate of pay for these...

Questions

Mathematics, 08.02.2021 23:10

Arts, 08.02.2021 23:10

Chemistry, 08.02.2021 23:10

Chemistry, 08.02.2021 23:10

Mathematics, 08.02.2021 23:10

Health, 08.02.2021 23:10

Physics, 08.02.2021 23:10

Mathematics, 08.02.2021 23:10

Mathematics, 08.02.2021 23:10

Advanced Placement (AP), 08.02.2021 23:10

Mathematics, 08.02.2021 23:10

Mathematics, 08.02.2021 23:10