Business, 26.11.2019 05:31 sjjarvis53211

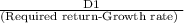

Driver products recently paid its annual dividend of $2, and reported an roe of 15%. the firm pays out 50% of its earnings as dividends. the stock has a beta of 1.44. the current risk-free rate is 2.5% and the market return is 11%. assuming that capm holds, what is the intrinsic value of this stock?

Answers: 1

Another question on Business

Business, 22.06.2019 21:00

Sue peters is the controller at vroom, a car dealership. dale miller recently has been hired as the bookkeeper. dale wanted to attend a class in excel spreadsheets, so sue temporarily took over dale's duties, including overseeing a fund used for gas purchases before test drives. sue found a shortage in the fund and confronted dale when he returned to work. dale admitted that he occasionally uses the fund to pay for his own gas. sue estimated the shortage at $450. what should sue do?

Answers: 3

Business, 23.06.2019 03:30

Sub to "j h" yt channel to be entered in a giveaway $50 visa

Answers: 1

Business, 23.06.2019 03:30

What does the term "smalling up" mean, according to white? what ways have you or people you know had to "small up"? if you haven't, what ways could you?

Answers: 2

Business, 23.06.2019 04:00

Asmall company has 10,000 shares. joan owns 200 of these shares. the company decided to split its shares. what is joan's ownership percentage after the split

Answers: 2

You know the right answer?

Driver products recently paid its annual dividend of $2, and reported an roe of 15%. the firm pays o...

Questions

Mathematics, 17.03.2020 19:29

History, 17.03.2020 19:30

English, 17.03.2020 19:30

Biology, 17.03.2020 19:30

Mathematics, 17.03.2020 19:30

Mathematics, 17.03.2020 19:30

Biology, 17.03.2020 19:30

Mathematics, 17.03.2020 19:30

Social Studies, 17.03.2020 19:30