Business, 26.11.2019 05:31 ryantrajean7

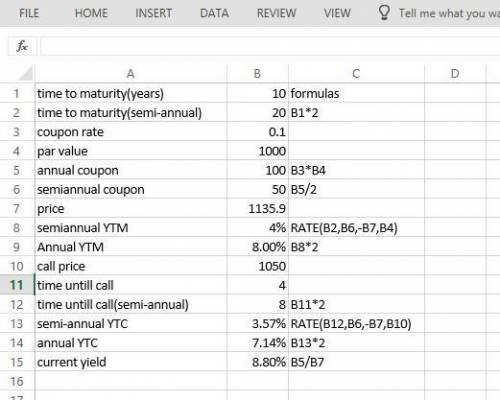

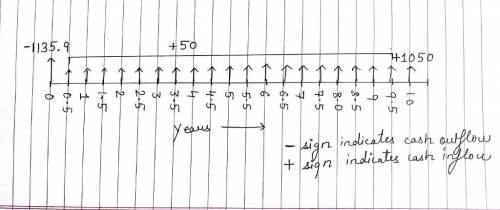

2) a 10-year, 10% semiannual coupon bond selling for $1,135.90 can be called in 4 years for $1,050 (hint: par value is $1,000). draw the time line? show your work what is its yield to maturity (ytm)? show your work what s its current yield (cy)? show your work what is its yield to call (ytc)? show your work.

Answers: 2

Another question on Business

Business, 21.06.2019 22:20

Amachine purchased three years ago for $720,000 has a current book value using straight-line depreciation of $400,000: its operating expenses are $60,000 per year. a replacement machine would cost $480,000, have a useful life of nine years, and would require $26,000 per year in operating expenses. it has an expected salvage value of $130,000 after nine years. the current disposal value of the old machine is $170,000: if it is kept 9 more years, its residual value would be $20,000. calculate the total costs in keeping the old machine and purchase a new machine. should the old machine be replaced?

Answers: 2

Business, 22.06.2019 11:30

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill. student a incorrect which is correct answer?

Answers: 2

Business, 22.06.2019 22:30

Luggage world buys briefcases with an invoice date of september 28. the terms of sale are 2/10 eom. what is the net date for this invoice

Answers: 1

Business, 22.06.2019 22:50

Amonopolist’s inverse demand function is p = 150 – 3q. the company produces output at two facilities; the marginal cost of producing at facility 1 is mc1(q1) = 6q1, and the marginal cost of producing at facility 2 is mc2(q2) = 2q2.a. provide the equation for the monopolist’s marginal revenue function. (hint: recall that q1 + q2 = q.)mr(q) = 150 - 6 q1 - 3 q2b. determine the profit-maximizing level of output for each facility.output for facility 1: output for facility 2: c. determine the profit-maximizing price.$

Answers: 3

You know the right answer?

2) a 10-year, 10% semiannual coupon bond selling for $1,135.90 can be called in 4 years for $1,050 (...

Questions

Mathematics, 19.02.2021 03:20

Mathematics, 19.02.2021 03:20

Mathematics, 19.02.2021 03:20

Mathematics, 19.02.2021 03:20

Physics, 19.02.2021 03:20

History, 19.02.2021 03:20

Chemistry, 19.02.2021 03:20

Mathematics, 19.02.2021 03:20

Physics, 19.02.2021 03:20

Mathematics, 19.02.2021 03:20

Mathematics, 19.02.2021 03:20

Biology, 19.02.2021 03:20