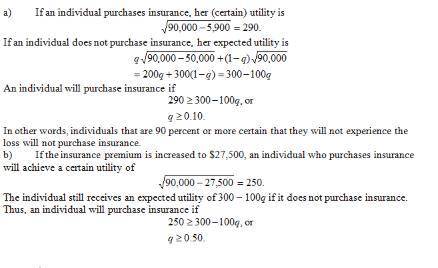

Consider a market of risk averse decision makers, each with a utility function u=√i each decision maker has an income of $90,000, but faces the possibility of a catastrophic loss of $50,000 in income. each decision maker can purchase an insurance policy that fully compensates her for her loss. this insurance policy has a cost of $5,900. suppose each decision maker potentially has a different probability p of experiencing the loss. a. what is the smallest value of p so that a decision maker purchases insurance? show your work. b. what would happen to this smallest value of p if the insurance company were to raise the insurance premium from $5,900 to $27,500?

Answers: 1

Another question on Business

Business, 21.06.2019 23:00

The impact fiscal multiplier is a. usually estimated to have an average value of 2. b. usually estimated to have an average value of 0. c. the actual immediate multiplier effect of a fiscal policy action after taking into consideration direct fiscal offsets and other short-term crowding out of private spending. d. the multiplier effect of a fiscal policy action that applies to a long-run period after all influences on equilibrium real gdp have been taken into account.

Answers: 3

Business, 22.06.2019 21:00

In a transportation minimization problem, the negative improvement index associated with a cell indicates that reallocating units to that cell would lower costs.truefalse

Answers: 1

Business, 22.06.2019 21:50

By which distribution system is more than 90 percent of u.s. coal shipped? a. pipelinesb. trucksc. waterwaysd. railroadse. none of the above

Answers: 1

Business, 22.06.2019 22:10

Which of the following tends to result in a decrease in the selling price of houses in an area? a. an increase in the population of the city or town. b. an increase in the labor costs of construction. c. an increase in the income of new residents in the city or town. d. an increase in mortgage interest rates.

Answers: 1

You know the right answer?

Consider a market of risk averse decision makers, each with a utility function u=√i each decision ma...

Questions

Mathematics, 23.10.2020 20:20

Mathematics, 23.10.2020 20:20

Advanced Placement (AP), 23.10.2020 20:20

English, 23.10.2020 20:20

Mathematics, 23.10.2020 20:20

Mathematics, 23.10.2020 20:20

Mathematics, 23.10.2020 20:20

Business, 23.10.2020 20:20

Mathematics, 23.10.2020 20:20

Mathematics, 23.10.2020 20:20

Mathematics, 23.10.2020 20:20