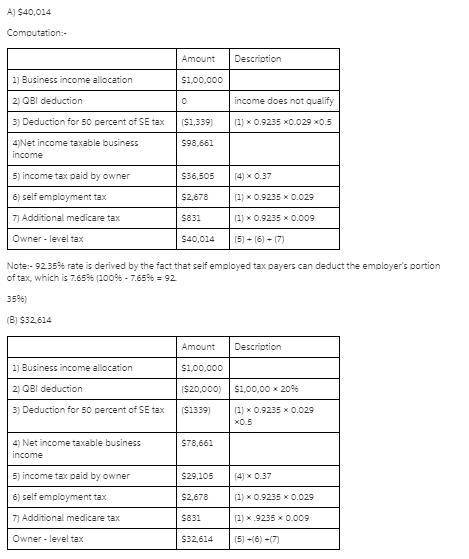

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $100,000 of business income from wcc for the year. jacob's marginal income tax rate is 37%. the business allocation is subject to 2.9% of self-employment tax and 0.9% additional medicare tax. a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Another question on Business

Business, 21.06.2019 18:50

Which of the following is not a potential problem with beta and its estimation? sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different than the "true" or "expected future" beta. the beta of "the market," can change over time, sometimes drastically.

Answers: 3

Business, 21.06.2019 20:20

If the government is required to balance the budget and the economy falls into a recession, which of the actions is a feasible policy response? cut taxes to encourage consumer spending invest in infrastructure increase government spending to stimulate the economy cut spending equal to the reduction in tax revenue what is a likely consequence of this policy? unemployment falls due to the economic stimulus. the negative consequences of the recession are magnified. consumer spending increases due to their ability to keep more of their after-tax income. there is hyperinflation due to an increase in aggregate demand.

Answers: 3

Business, 22.06.2019 06:00

List three careers that require knowledge of science. list three careers that require the use of of math. list three careers that require the use of foreign language. list three careers that require the use of good writing skills. list three careers that require the use of good computer skills.

Answers: 3

Business, 22.06.2019 20:30

Blue computers, a major pc manufacturer in the united states, currently has plants in kentucky and pennsylvania. the kentucky plant has a capacity of 1 million units a year and the pennsylvania plant has a capacity of 1.5 million units a year. the firm divides the united states into five markets: northeast, southeast, midwest, south, and west. each pc sells for $1,000. the firm anticipates a 50 perc~nt growth in demand (in each region) this year (after which demand will stabilize) and wants to build a plant with a capacity of 1.5 million units per year to accommodate the growth. potential sites being considered are in north carolina and california. currently the firm pays federal, state, and local taxes on the income from each plant. federal taxes are 20 percent of income, and all state and local taxes are 7 percent of income in each state. north carolina has offered to reduce taxes for the next 10 years from 7 percent to 2 percent. blue computers would like to take the tax break into consideration when planning its network. consider income over the next 10 years in your analysis. assume that all costs remain unchanged over the 10 years. use a discount factor of 0.1 for your analysis. annual fixed costs, production and shipping costs per unit, and current regional demand (before the 50 percent growth) are shown in table 5-13. (a) if blue computers sets an objective of minimizing total fixed and variable costs, where should they build the new plant? how should the network be structured? (b) if blue computers sets an objective of maximizing after-tax profits, where should they build the new plant? how should the network be structured? variable production and shipping cost ($/unit) annual fixed cost northeast southeast midwest south west (million$) kentucky 185 180 175 175 200 150 pennsylvania 170 190 180 200 220 200 n. carolina 180 180 185 185 215 150 california 220 220 195 195 175 150 demand ('000 units/month) 700 400 400 300 600

Answers: 3

You know the right answer?

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $100,000 of business i...

Questions

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Biology, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Social Studies, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

English, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

Mathematics, 11.09.2020 09:01

English, 11.09.2020 09:01