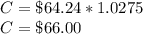

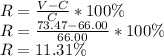

You purchased shares of stock one year ago at a price of $64.24 per share.

during the year, y...

Answers: 1

Another question on Business

Business, 22.06.2019 05:20

What are the general categories of capital budget scenarios? describe the overall decision-making context for each.

Answers: 3

Business, 22.06.2019 06:00

Suppose that a monopolistically competitive restaurant is currently serving 260 meals per day (the output where mr

Answers: 2

Business, 22.06.2019 10:30

Zapper has beginning equity of $257,000, net income of $51,000, dividends of $40,000 and investments by stockholders of $6,000. its ending equity is

Answers: 2

Business, 22.06.2019 18:00

Large public water and sewer companies often become monopolies because they benefit from although the company faces high start-up costs, the firm experiences average production costs as it expands and adds more customers. smaller competitors would experience average costs and would be less

Answers: 1

You know the right answer?

Questions

English, 27.07.2021 07:10

Mathematics, 27.07.2021 07:10

Mathematics, 27.07.2021 07:10

Biology, 27.07.2021 07:10

Chemistry, 27.07.2021 07:10

Business, 27.07.2021 07:10

Physics, 27.07.2021 07:10

History, 27.07.2021 07:10

Physics, 27.07.2021 07:10