Business, 26.11.2019 19:31 brevenb375

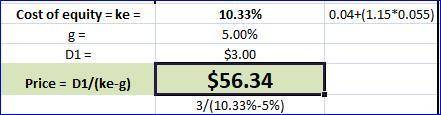

The edward company is expected to pay a dividend of d1 = $3.00 per share at the end of the year, and that dividend is expected to grow at a constant rate of 5.00% per year in the future. the company's beta is 1.15, the market risk premium is 5.50%, and the risk-free rate is 4.00%. what is the company's current stock price?

Answers: 2

Another question on Business

Business, 21.06.2019 19:20

Which of the following best explains why large companies have an advantage over smaller companies? a. economies of scale make it possible to offer lower prices. b. the production possibilities frontier is wider for a larger company. c. decreasing marginal utility enables more efficient production. d. increasing the scale of production leads to a reduction in inputs.2b2t

Answers: 1

Business, 22.06.2019 15:40

Aprice control is: question 1 options: a)a tax on the sale of a good that controls the market price.b)an upper limit on the quantity of some good that can be bought or sold.c)a legal restriction on how high or low a price in a market may go.d)control of the price of a good by the firm that produces it.

Answers: 1

Business, 22.06.2019 19:00

Which of the following would cause a shift to the right of the supply curve for gasoline? i. a large increase in the price of public transportation. ii. a large decrease in the price of automobiles. iii. a large reduction in the costs of producing gasoline

Answers: 1

Business, 23.06.2019 02:00

What percentage of hard rock's profit is derived from retail shop sales?

Answers: 1

You know the right answer?

The edward company is expected to pay a dividend of d1 = $3.00 per share at the end of the year, and...

Questions

History, 02.12.2019 21:31

History, 02.12.2019 21:31

Social Studies, 02.12.2019 21:31

Chemistry, 02.12.2019 21:31

Social Studies, 02.12.2019 21:31

Mathematics, 02.12.2019 21:31

Mathematics, 02.12.2019 21:31

Mathematics, 02.12.2019 21:31

Mathematics, 02.12.2019 21:31

Chemistry, 02.12.2019 21:31