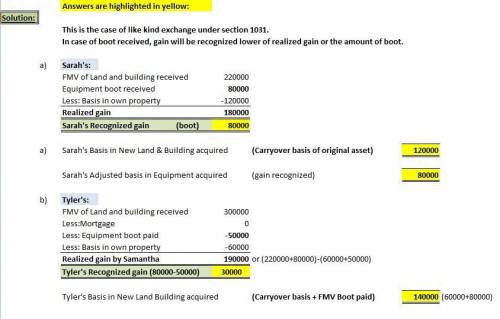

Sarah exchanges a building and land (used in her business) for tyler’s land and building and some equipment (used in his business). the assets have the following characteristics. adjusted basis fair market value sarah’s real property $120,000 $300,000 tyler’s real property 60,000 220,000 equipment 50,000 80,000 what are sarah’s recognized gain or loss and basis for the land and building and equipment acquired from tyler

Answers: 3

Another question on Business

Business, 22.06.2019 15:00

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

Business, 22.06.2019 23:00

Which completes the equation? o + a + consideration (+ = k legal capacity legal capability legal injunction legal corporation

Answers: 1

Business, 22.06.2019 23:30

Which external factor has enabled addition of special effects in advertisements and tracking of responses of customers over websites?

Answers: 3

You know the right answer?

Sarah exchanges a building and land (used in her business) for tyler’s land and building and some eq...

Questions

Mathematics, 18.11.2020 03:20

Mathematics, 18.11.2020 03:20

Computers and Technology, 18.11.2020 03:20

Physics, 18.11.2020 03:20

Mathematics, 18.11.2020 03:20

Mathematics, 18.11.2020 03:20

Mathematics, 18.11.2020 03:20

Mathematics, 18.11.2020 03:20

Advanced Placement (AP), 18.11.2020 03:20

Mathematics, 18.11.2020 03:20

Mathematics, 18.11.2020 03:20

Mathematics, 18.11.2020 03:20

Mathematics, 18.11.2020 03:20