Perit industries has $190,000 to invest. the company is trying to decide between two alternative uses of the funds. the alternatives are: project a project b cost of equipment required $ 190,000 $ 0 working capital investment required $ 0 $ 190,000 annual cash inflows $ 28,000 $ 48,000 salvage value of equipment in six years $ 8,900 $ 0 life of the project 6 years 6 years the working capital needed for project b will be released at the end of six years for investment elsewhere. perit industries’ discount rate is 15%. click here to view exhibit 12b-1 and exhibit 12b-2, to determine the appropriate discount factor(s) using tables.

required:

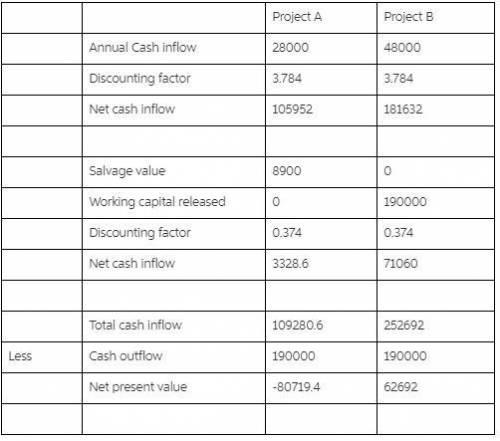

1. compute the net present value of project a. (enter negative value with a minus sign. round your final answer to the nearest whole dollar amount.)

2. compute the net present value of project b. (enter negative value with a minus sign. round your final answer to the nearest whole dollar amount.)

3. which investment alternative (if either) would you recommend that the company accept?

Answers: 3

Another question on Business

Business, 22.06.2019 08:00

Interest is credited to a fixed annuity no lower than the variable contract rate contract guaranteed rate current rate of inflation prime rate

Answers: 2

Business, 22.06.2019 10:00

mary's baskets company expects to manufacture and sell 30,000 baskets in 2019 for $5 each. there are 4,000 baskets in beginning finished goods inventory with target ending inventory of 4,000 baskets. the company keeps no work-in-process inventory. what amount of sales revenue will be reported on the 2019 budgeted income statement?

Answers: 2

Business, 22.06.2019 12:30

Suppose that two firms produce differentiated products and compete in prices. as in class, the two firms are located at two ends of a line one mile apart. consumers are evenly distributed along the line. the firms have identical marginal cost, $60. firm b produces a product with value $110 to consumers.firm a (located at 0 on the unit line) produces a higher quality product with value $120 to consumers. the cost of travel are directly related to the distance a consumer travels to purchase a good. if a consumerhas to travel a mile to purchase a good, the incur a cost of $20. if they have to travel x fraction of a mile, they incur a cost of $20x. (a) write down the expressions for how much a consumer at location d would value the products sold by firms a and b, if they set prices p_{a} and p_{b} ? (b) based on your expressions in (a), how much will be demanded from each firm if prices p_{a} and p_{b} are set? (c) what are the nash equilibrium prices?

Answers: 3

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 2

You know the right answer?

Perit industries has $190,000 to invest. the company is trying to decide between two alternative use...

Questions

Mathematics, 15.02.2021 15:50

Physics, 15.02.2021 15:50

Business, 15.02.2021 15:50

Chemistry, 15.02.2021 15:50

Mathematics, 15.02.2021 16:00

Social Studies, 15.02.2021 16:00

English, 15.02.2021 16:00

Biology, 15.02.2021 16:00

Mathematics, 15.02.2021 16:00

Mathematics, 15.02.2021 16:00

Biology, 15.02.2021 16:00