Business, 27.11.2019 00:31 coronadohayden

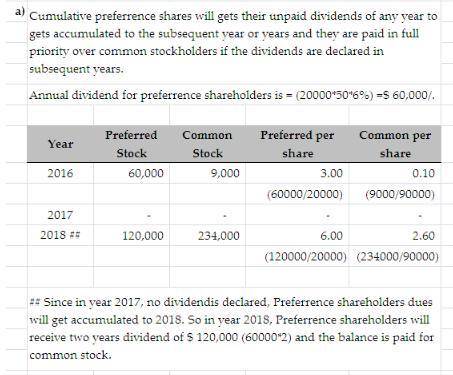

Chauncey corporation began business on june 30, 2016. at that time, it issued 20,000 shares of $50 par value, six percent, cumulative preferred stock and 90,000 shares of $10 par value common stock. through the end of 2018, there had been no change in the number of preferred and common shares outstanding. required a. assume that chauncey declared dividends of $69,000 in 2016, $0 in 2017, and $354,000 in 2018. calculate the total dividends and the dividends per share paid to each class of stock in 2016, 2017, and 2018. round to two decimal places.

Answers: 1

Another question on Business

Business, 22.06.2019 08:30

In risk management, what does risk control include? a. risk identification b. risk analysis c. risk prioritization d. risk management planning e. risk elimination need this answer now : (

Answers: 3

Business, 22.06.2019 11:30

Mark knopf is an auditor who has been asked to provide an audit and financial statement certification for a company that is going public on the new york stock exchange. knopf wants to know his personal liability if the company provides him with inaccurate or false information. which of the following sources of law will him answer that question? a. the city ordinances where the company headquarters is located. b. the state constitution of the state where the company is incorporated. c. code of federal regulations. d. all of the above

Answers: 1

Business, 22.06.2019 12:10

Lambert manufacturing has $100,000 to invest in either project a or project b. the following data are available on these projects (ignore income taxes.): project a project b cost of equipment needed now $100,000 $60,000 working capital investment needed now - $40,000 annual cash operating inflows $40,000 $35,000 salvage value of equipment in 6 years $10,000 - both projects will have a useful life of 6 years and the total cost approach to net present value analysis. at the end of 6 years, the working capital investment will be released for use elsewhere. lambert's required rate of return is 14%. the net present value of project b is:

Answers: 2

Business, 22.06.2019 20:30

Casey communications recently issued new common stock and used the proceeds to pay off some of its short-term notes payable. this action had no effect on the company's total assets or operating income. which of the following effects would occur as a result of this action? a. the company's current ratio increased.b. the company's times interest earned ratio decreased.c. the company's basic earning power ratio increased.d. the company's equity multiplier increased.e. the company's debt ratio increased.

Answers: 3

You know the right answer?

Chauncey corporation began business on june 30, 2016. at that time, it issued 20,000 shares of $50 p...

Questions

Mathematics, 28.06.2020 02:01

Mathematics, 28.06.2020 02:01

Mathematics, 28.06.2020 02:01

Mathematics, 28.06.2020 02:01

Mathematics, 28.06.2020 02:01