Julie has just retired. her company’s retirement program has two options as to how retirement benefits can be received. under the first option, julie would receive a lump sum of $157,000 immediately as her full retirement benefit. under the second option, she would receive $20,000 each year for 6 years plus a lump-sum payment of $65,000 at the end of the 6-year period. click here to view exhibit 12b-1 and exhibit 12b-2, to determine the appropriate discount factor(s) using tables.

required:

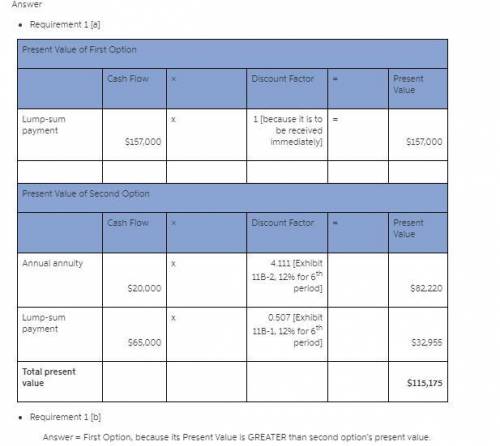

1-a. calculate the present value for the following assuming that the money can be invested at 12%.

1-b. if she can invest money at 12%, which option would you recommend that she accept

Answers: 1

Another question on Business

Business, 21.06.2019 17:50

Which of the following best explains why a large company can undersell small retailers? a. large companies can offer workers lower wages because they provide more jobs. b. large companies can pay their employees less because they do unskilled jobs. c. large companies can negotiate better prices with wholesalers. d. large companies have fewer expenses associated with overhead.

Answers: 1

Business, 21.06.2019 19:30

What is the most important factor that affects the value of a company? a) cash flow b) earnings c) supply and demand d) number of employees

Answers: 1

Business, 21.06.2019 19:50

Suppose your rich uncle gave you $50,000, which you plan to use for graduate school. you will make the investment now, you expect to earn an annual return of 6%, and you will make 4 equal annual withdrawals, beginning 1 year from today. under these conditions, how large would each withdrawal be so there would be no funds remaining in the account after the 4th?

Answers: 1

Business, 22.06.2019 12:10

This exercise illustrates that poor quality can affect schedules and costs. a manufacturing process has 130 customer orders to fill. each order requires one component part that is purchased from a supplier. however, typically, 3% of the components are identified as defective, and the components can be assumed to be independent. (a) if the manufacturer stocks 130 components, what is the probability that the 130 orders can be filled without reordering components? (b) if the manufacturer stocks 132 components, what is the probability that the 130 orders can be filled without reordering components? (c) if the manufacturer stocks 135 components, what is the probability that the 130 orders can be filled without reordering components?

Answers: 3

You know the right answer?

Julie has just retired. her company’s retirement program has two options as to how retirement benefi...

Questions

History, 14.02.2020 03:45

Computers and Technology, 14.02.2020 03:46