Business, 27.11.2019 04:31 christianconklin22

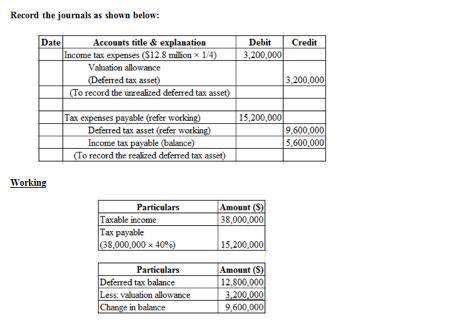

At the end of the year, the deferred tax asset account had a balance of $12.8 million attributable to a cumulative temporary difference of $32 million in a liability for estimated expenses. taxable income is $38.0 million. no temporary differences existed at the beginning of the year, and the tax rate is 40%.prepare the journal entry(s) to record income taxes assuming it is more likely than not that one-fourth of the deferred tax asset will not ultimately be realized. note: these are the correct entries, i am just missing the values (dta is not zero): debit: income tax expense deferred tax asset : income tax payable 15.2debit: income tax expense : valuation allowance - deferred tax asset

Answers: 3

Another question on Business

Business, 22.06.2019 07:00

Imagine you own an established startup with growing profits. you are looking for funding to greatly expand company operations. what method of financing would be best for you?

Answers: 2

Business, 22.06.2019 09:30

Cash flows during the first year of operations for the harman-kardon consulting company were as follows: cash collected from customers, $385,000; cash paid for rent, $49,000; cash paid to employees for services rendered during the year, $129,000; cash paid for utilities, $59,000. in addition, you determine that customers owed the company $69,000 at the end of the year and no bad debts were anticipated. also, the company owed the gas and electric company $2,900 at year-end, and the rent payment was for a two-year period.

Answers: 1

Business, 22.06.2019 16:30

Why are there so many types of diversion programs for juveniles

Answers: 2

Business, 22.06.2019 22:00

Indicate whether each of the following companies is primarily a service, merchandise, or manufacturing business. if you are unfamiliar with the company, use the internet to locate the company's home page or use the finance web site of yahoo. 1. alcoa inc. 2. boeing 3. caterpillar 4. citigroup inc. 5. cvs 6. dow chemical company 7. ebay inc. 8. fedex 9. ford motor company 10. gap inc. 11. h& r block 12. hilton hospitality, inc. 13. procter & gamble 14. suntrust 15. walmart stores, inc.

Answers: 3

You know the right answer?

At the end of the year, the deferred tax asset account had a balance of $12.8 million attributable t...

Questions

Mathematics, 22.06.2021 18:50

Spanish, 22.06.2021 18:50

Mathematics, 22.06.2021 19:00

Mathematics, 22.06.2021 19:00

English, 22.06.2021 19:00

English, 22.06.2021 19:00

Computers and Technology, 22.06.2021 19:00

Mathematics, 22.06.2021 19:00

Mathematics, 22.06.2021 19:00