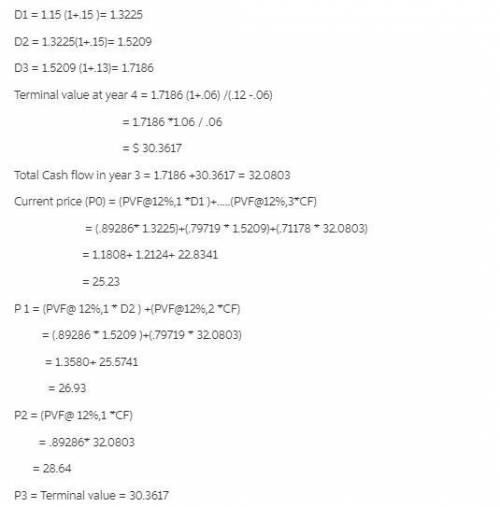

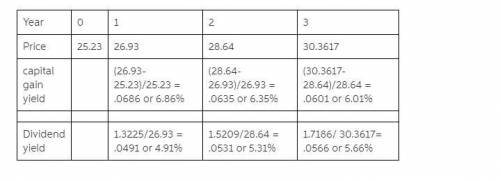

Turbo technology computers is experiencing a period of rapid growth. earnings and dividends are expected to grow at a rate of 15% during the next two years, at 13% in the third year, and at a constant rate of 6% thereafter. turbo’s last dividend was $1.15, and the required rate of return on the stock is 12%.calculate the dividend yield and capital gains yield for years 1, 2, and 3.

Answers: 2

Another question on Business

Business, 21.06.2019 21:30

Afreezer manufacturer might purchase sheets of steel, wiring, shelving, and so forth, as part of its final product. this is an example of what sub-classification of business market?

Answers: 1

Business, 22.06.2019 05:00

What is a sort of auction for stocks in which traders verbally submit their offers?

Answers: 3

Business, 23.06.2019 20:00

Crossminus−sectional ratio analysis is used to a. correct expected problems in operations b. provide conclusive evidence of the existence of a problem c. measure relative performance of a firm with its peers d. isolate the causes of problems

Answers: 1

You know the right answer?

Turbo technology computers is experiencing a period of rapid growth. earnings and dividends are expe...

Questions

History, 13.03.2020 22:00