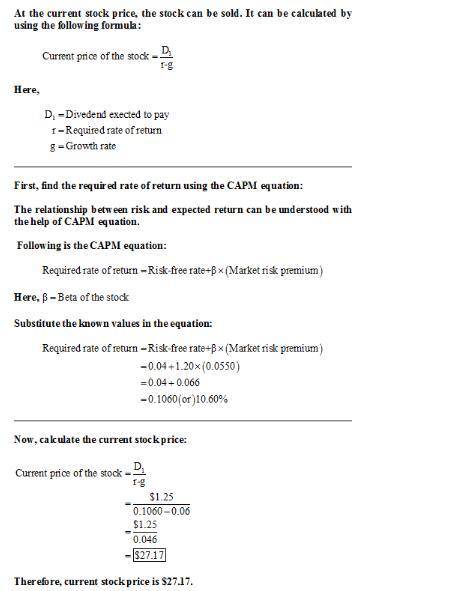

The francis company is expected to pay a dividend of d1 = $1.25 per share at the end of the year, and that dividend is expected to grow at a constant rate of 6.00% per year in the future. the company's beta is 1.70, the market risk premium is 5.50%, and the risk-free rate is 4.00%. what is the company's current stock price? do not round intermediate calculations.

Answers: 3

Another question on Business

Business, 22.06.2019 05:00

What is a sort of auction for stocks in which traders verbally submit their offers?

Answers: 3

Business, 22.06.2019 21:40

Which of the following distribution systems offers speed and reliability when emergency supplies are needed overseas? a. railroadsb. airfreightc. truckingd. pipelinese. waterways

Answers: 2

Business, 22.06.2019 22:00

Anheuser-busch inbev is considering you for an entry-level brand management position. you have been asked to prepare an analysis of the u.s. craft beer industry as part of the selection process. prepare a 3-5 page report that includes a description of the industry’s strategically relevant macro-environmental components, evaluates competition in the industry, assesses drivers of change and industry dynamics, and lists industry key success factors. the company’s management also asks that you propose the basic elements of a strategic action plan that will allow the company to improve its competitive position in the market for craft beer. you must provide a heading in your report for each of the required elements of the assignment.

Answers: 3

Business, 23.06.2019 04:10

Which of the following would not be listed under cash outflows in a financial plan?

Answers: 2

You know the right answer?

The francis company is expected to pay a dividend of d1 = $1.25 per share at the end of the year, an...

Questions

Mathematics, 26.01.2020 08:31

Mathematics, 26.01.2020 08:31

English, 26.01.2020 08:31

Geography, 26.01.2020 08:31

Mathematics, 26.01.2020 08:31

Mathematics, 26.01.2020 08:31

English, 26.01.2020 08:31

Mathematics, 26.01.2020 08:31

Mathematics, 26.01.2020 08:31

Biology, 26.01.2020 08:31

Chemistry, 26.01.2020 08:31

History, 26.01.2020 08:31