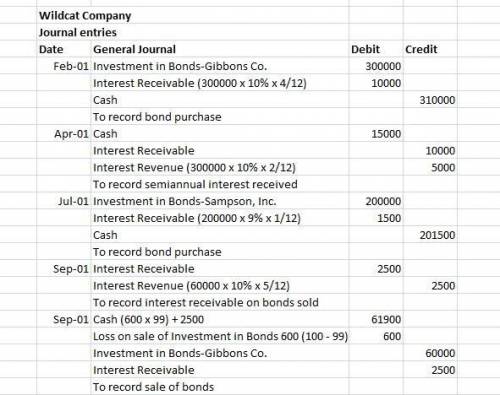

The following information relates to the debt securities investments of wildcat company.

...

Business, 28.11.2019 00:31 wywy122003

The following information relates to the debt securities investments of wildcat company.

1.

on february 1, the company purchased 10% bonds of gibbons co. having a par value of $300,000 at 100 plus accrued interest. interest is payable april 1 and october 1.

2.

on april 1, semiannual interest is received.

3.

on july 1, 9% bonds of sampson, inc. were purchased. these bonds with a par value of $200,000 were purchased at 100 plus accrued interest. interest dates are june 1 and december 1.

4. on september 1, bonds with a par value of $60,000, purchased on february 1, are sold at 99 plus accrued interest.

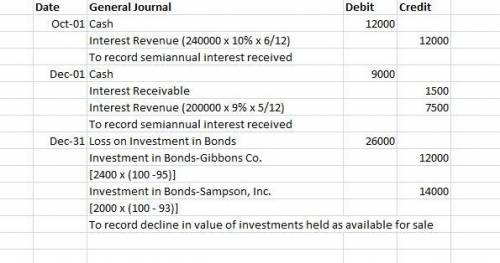

5. on october 1, semiannual interest is received.

6. on december 1, semiannual interest is received.

7.

on december 31, the fair value of the bonds purchased february 1 and july 1 are 95 and 93, respectively.

prepare any journal entries you consider necessary, including year-end entries (december 31), assuming these are available-for-sale securities.

Answers: 1

Another question on Business

Business, 21.06.2019 18:00

Sara bought 12 3/4 cakes sara's friends ate 3/8 how much cake is left

Answers: 1

Business, 21.06.2019 20:30

Andrew cooper decides to become a part owner of a corporation. as a part owner, he expects to receive a profit as payment because he has assumed the risk of - serious inflation eroding the purchasing power of his investment.- being paid before the suppliers and employees are paid.- losing his home, car, and life savings.- losing the money he has invested in the corporation and not receiving profits.- the company giving all of the profits to local communities

Answers: 2

Business, 22.06.2019 07:40

The cutting department of cassel company has the following production and cost data for july. production costs 1. transferred out 12,300 units. beginning work in process $0 2. started 3,900 units that are 60% materials 62,856 complete as to conversion labor 12,622 costs and 100% complete as manufacturing overhead 23,100 to materials at july 31. materials are entered at the beginning of the process. conversion costs are incurred uniformly during the process. determine the equivalent units of production for (1) materials and (2) conversion costs. materials conversion costs total equivalent units of production link to text link to text compute unit costs. (round unit costs to 2 decimal places, e.g. 2.25.) materials $ conversion costs $ link to text link to text prepare a cost reconciliation schedule. (round unit costs to 2 decimal places, e.g. 2.25 and final answers to 0 decimal places, e.g. 1,225.) cost reconciliation costs accounted for transferred out $ work in process, july 31 materials $ conversion costs total costs $

Answers: 1

Business, 22.06.2019 13:30

1. is the act of declaring a drivers license void and terminated when it is determined that the license was issued through error or fraud.

Answers: 2

You know the right answer?

Questions

English, 02.03.2021 03:10

Chemistry, 02.03.2021 03:10

Mathematics, 02.03.2021 03:10

Computers and Technology, 02.03.2021 03:10

Computers and Technology, 02.03.2021 03:10

Mathematics, 02.03.2021 03:10

Physics, 02.03.2021 03:10

English, 02.03.2021 03:10

Mathematics, 02.03.2021 03:10