Business, 28.11.2019 02:31 patelandrew816

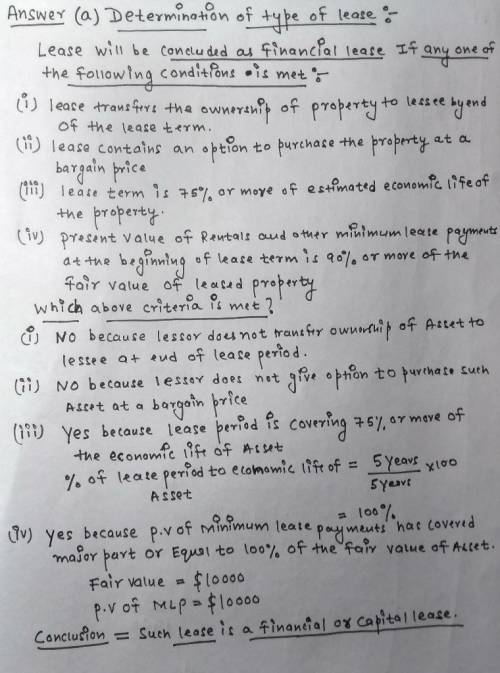

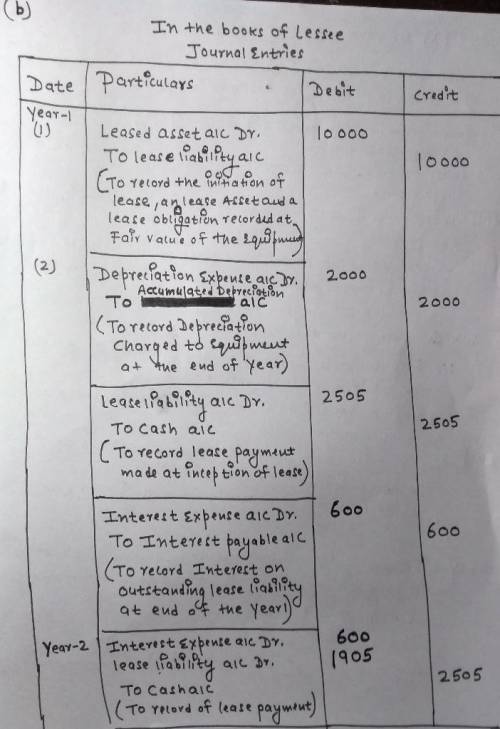

Acomparison between operating lease and capital lease now assume that company abc leases an equipment for 5 years instead. other information mostly remains the same (except for highlighted texts) leased assets have an expected life of 5 years depreciation is straight line annual lease payment is $2,505. *interest rate is 8%. the ownership of the property goes back to the lessor at the end of the lease term lease payments are made at beginning of each year *the present value of the lease payment is 10,000 (present value of 2,505 ordinary annuity for 5 years at 8%) fair value of the equipment is 10,000 the lease does not contain a bargain purchase option a. determining type of lease. lease transfers ownership of property to lessee by end of the lease term (ii) lease contains an option to purchase the property at a bargain price (iii) lease term is 75% or more of estimated economic life of the property v) the present value of rentals and other minimum lease payments at beginning of lease term is 90% or more of the fair value of leased property which of the above criteria is met? correct correct correct correct based on your answers above, what type of lease is this? correct (ii) no ii) yes (iv) yes capital lease b. to record the type of lease indicated above, multiple journal entries are required 1) to record the initiation of the lease, an lease asset and a lease obligation is recorded on the book at the fair value of the equipment dr: asset correct 1 correct cr: lease liability correct 1 correct 2) at the end of year 1, the following two journal entries are recorded first, as the lessee recorded the "leased asset" on the balance sheet, it is necessary to depreciate this asset. to record the depreciation expense using the straight-line depreciation method to record the depreciation expense using the straight-line depreciation method (over a 5-year period, no residual value), the company records the following je dr: eciation expense 2000 correct correct accumulated dr correct cr: 2000 correct second, at the time the lessee makes cosh payment of $2505, a portion of that is considered payment of interest expense (coiculoted os principle times interest rotel the rest is considered repoyment ot principle (this is exactly like when you pay a mortgage on a car or a house) the following journal entry is he recorded inter est expense lease liability correct correct cash enter amount enter amount correct 2505 correct

Answers: 2

Another question on Business

Business, 22.06.2019 01:00

An investment counselor calls with a hot stock tip. he believes that if the economy remains strong, the investment will result in a profit of $40 comma 00040,000. if the economy grows at a moderate pace, the investment will result in a profit of $10 comma 00010,000. however, if the economy goes into recession, the investment will result in a loss of $40 comma 00040,000. you contact an economist who believes there is a 2020% probability the economy will remain strong, a 7070% probability the economy will grow at a moderate pace, and a 1010% probability the economy will slip into recession. what is the expected profit from this investment?

Answers: 2

Business, 22.06.2019 05:00

Which of the following differentiates cost accounting and financial accounting? a. the primary users of cost accounting are the investors, whereas the primary users of financial accounting are the managers. b. cost accounting measures only the financial information related to the costs of acquiring fixed assets in an organization, whereas financial accounting measures financial and nonfinancial information of a company's business transactions. c. cost accounting measures information related to the costs of acquiring or using resources in an organization, whereas financial accounting measures a financial position of a company to investors, banks, and external parties. d. cost accounting deals with product design, production, and marketing strategies, whereas financial accounting deals mainly with pricing of the products.

Answers: 3

Business, 22.06.2019 09:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 3

Business, 22.06.2019 10:10

Rats that received electric shocks were unlikely to develop ulcers if the

Answers: 1

You know the right answer?

Acomparison between operating lease and capital lease now assume that company abc leases an equipmen...

Questions

Mathematics, 26.06.2019 00:50

World Languages, 26.06.2019 00:50

Mathematics, 26.06.2019 00:50

Mathematics, 26.06.2019 00:50

Arts, 26.06.2019 00:50

Mathematics, 26.06.2019 00:50

History, 26.06.2019 00:50

Social Studies, 26.06.2019 00:50

Advanced Placement (AP), 26.06.2019 00:50