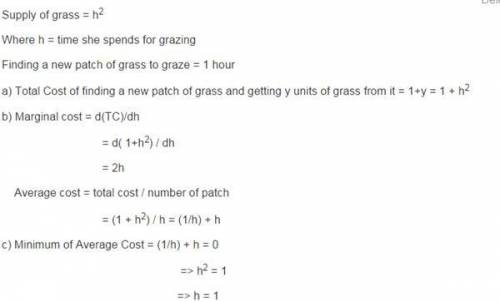

Hildegard, an intelligent and charming holstein cow, grazes in a very large, mostly barren pasture with a few patches of lush grass. when she finds a new grassy area, the amount of grass she gets from it is equal to the square root of the number of hours, h, that she spends grazing there. finding a new patch of grass on which to graze takes her 1 hour. since hildegard does not have pockets, the currency in which her costs are measured is time. (a) what is the total cost to hildegard of finding a new patch of grass and getting y units of grass from it? (b) find an expression for her marginal and her average costs per patch of grass as a function of the amount of grass she gets from each patch. (c) how much time would she spend in each patch if she wanted to maximize her food intake? (hint: minimize the average cost per unit of grass eaten.)

Answers: 3

Another question on Business

Business, 22.06.2019 10:30

Jack manufacturing company had beginning work in process inventory of $8,000. during the period, jack transferred $34,000 of raw materials to work in process. labor costs amounted to $41,000 and overhead amounted to $36,000. if the ending balance in work in process inventory was $12,000, what was the amount transferred to finished goods inventory?

Answers: 2

Business, 22.06.2019 20:20

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

Business, 22.06.2019 21:40

Western electric has 32,000 shares of common stock outstanding at a price per share of $79 and a rate of return of 13.00 percent. the firm has 7,300 shares of 7.80 percent preferred stock outstanding at a price of $95.00 per share. the preferred stock has a par value of $100. the outstanding debt has a total face value of $404,000 and currently sells for 111 percent of face. the yield to maturity on the debt is 8.08 percent. what is the firm's weighted average cost of capital if the tax rate is 39 percent?

Answers: 2

Business, 23.06.2019 04:00

Asmall company has 10,000 shares. joan owns 200 of these shares. the company decided to split its shares. what is joan's ownership percentage after the split

Answers: 2

You know the right answer?

Hildegard, an intelligent and charming holstein cow, grazes in a very large, mostly barren pasture w...

Questions

Mathematics, 05.05.2020 07:19

Mathematics, 05.05.2020 07:19

Chemistry, 05.05.2020 07:19