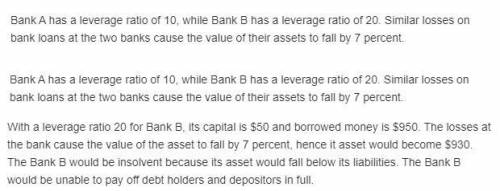

Bank a has a leverage ratio of 10, while bank b has a leverage ratio of 20. similar losses on bank loans at the two banks cause the value of their assets to fall by 7 percent. which bank shows alarger change in bank capital? does either bank remain solvent? explain.

Answers: 2

Another question on Business

Business, 21.06.2019 22:00

The market yield on spice grills' bonds is 15%, and the firm's marginal tax rate is 33%. what is their shareholders' required return if the equity risk premium is 4%?

Answers: 1

Business, 22.06.2019 01:10

Technology corp. is considering a $238,160 investment in a new marketing campaign that it anticipates will provide annual cash flows of $52,000 for the next five years. the firm has a 6% cost of capital. what should the analysis indicate to the firm's managers?

Answers: 2

Business, 22.06.2019 01:20

What cylinder head operation is the technician performing in this figure?

Answers: 1

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

You know the right answer?

Bank a has a leverage ratio of 10, while bank b has a leverage ratio of 20. similar losses on bank l...

Questions

Chemistry, 22.12.2019 22:31

Biology, 22.12.2019 22:31

Biology, 22.12.2019 22:31

History, 22.12.2019 22:31

History, 22.12.2019 22:31

Physics, 22.12.2019 22:31

English, 22.12.2019 22:31

Geography, 22.12.2019 22:31

English, 22.12.2019 23:31