Business, 28.11.2019 04:31 SushiMagic

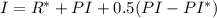

Assume that we currently have an inflation rate of 1%, a nominal federal funds rate of 2% and a real federal funds rate of 1%. now assume that we expect inflation to increase to 3 %. with a 3% inflation rate it is determined that the real federal funds rate should be 3%, so in accordance to the taylor rule, what should the nominal federal funds rate be changed to?

Answers: 1

Another question on Business

Business, 22.06.2019 20:00

What part of the rational model of decision-making does the former business executive “elliott” have a problem completing?

Answers: 2

Business, 23.06.2019 02:50

Three years ago, stock tek purchased some five-year macrs property for $82,600. today, it is selling this property for $31,500. how much tax will the company owe on this sale if the tax rate is 34 percent? the macrs allowance percentages are as follows, commencing with year 1: 20.00, 32.00, 19.20, 11.52, 11.52, and 5.76 percent.

Answers: 1

Business, 23.06.2019 22:10

Like fuel, air, and heat come together to make fire, the likelihood of fraud increases when the three elements of the fraud triangle come together. analyze how the three elements of the fraud triangle are important and how all three elements were present in helen’s case.

Answers: 1

Business, 24.06.2019 01:30

Asteel company sells some steel to a bicycle company for $100. the bicycle company uses the steel to produce a bicycle, which it sells for $200. taken together, these two transactions contribute

Answers: 2

You know the right answer?

Assume that we currently have an inflation rate of 1%, a nominal federal funds rate of 2% and a real...

Questions

English, 16.10.2019 14:30

Mathematics, 16.10.2019 14:30

Mathematics, 16.10.2019 14:30

Physics, 16.10.2019 14:30

Mathematics, 16.10.2019 14:30

Mathematics, 16.10.2019 14:30

History, 16.10.2019 14:30

Mathematics, 16.10.2019 14:30

English, 16.10.2019 14:30

History, 16.10.2019 14:30

History, 16.10.2019 14:30

Social Studies, 16.10.2019 14:30

Mathematics, 16.10.2019 14:30