Business, 28.11.2019 06:31 ashtonbillups

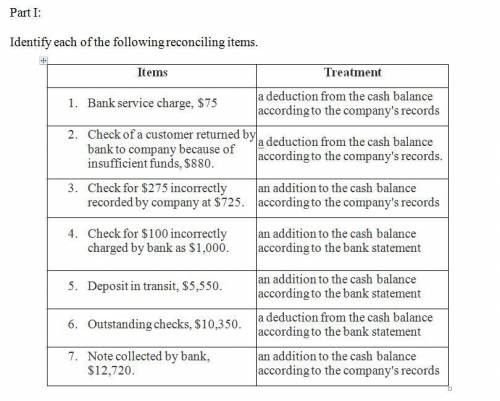

Identify each of the following reconciling items as: an addition to the cash balance according to the bank statementa deduction from the cash balance according to the bank statementan addition to the cash balance according to the company's recordsa deduction from the cash balance according to the company's records(none of the transactions reported by bank debit and credit memos have been recorded by the company.)item treatment1. bank service charges, $75. 2. check of a customer returned by bank to company because of insufficient funds, $880. 3. check for $275 incorrectly recorded by the company as $725. 4. check for $100 incorrectly charged by bank as $1,000. 5. deposit in transit, $5,550. 6. outstanding checks, $10,350. 7. note collected by bank, $12,720.part iientries based on bank reconciliationwhich of the reconciling items listed below require an entry in the company's accounts? (none of the transactions reported by bank debit and credit memos have been recorded by the company.)item entry required1. bank service charges. 2. nsf check returned to company by the bank. 3. check incorrectly recorded by company. 4. check incorrectly charged by bank. 5. deposit in transit. 6. outstanding checks.

Answers: 1

Another question on Business

Business, 22.06.2019 11:40

The following pertains to smoke, inc.’s investment in debt securities: on december 31, year 3, smoke reclassified a security acquired during the year for $70,000. it had a $50,000 fair value when it was reclassified from trading to available-for-sale. an available-for-sale security costing $75,000, written down to $30,000 in year 2 because of an other-than-temporary impairment of fair value, had a $60,000 fair value on december 31, year 3. what is the net effect of the above items on smoke’s net income for the year ended december 31, year 3?

Answers: 3

Business, 22.06.2019 15:40

Brandt enterprises is considering a new project that has a cost of $1,000,000, and the cfo set up the following simple decision tree to show its three most likely scenarios. the firm could arrange with its work force and suppliers to cease operations at the end of year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties. how much is the option to abandon worth to the firm?

Answers: 1

Business, 22.06.2019 20:30

Exercise 7-7 martinez company reports the following financial information before adjustments. dr. cr. accounts receivable $168,900 allowance for doubtful accounts $3,200 sales revenue (all on credit) 849,300 sales returns and allowances 50,440 prepare the journal entry to record bad debt expense assuming martinez company estimates bad debts at (a) 4% of accounts receivable and (b) 4% of accounts receivable but allowance for doubtful accounts had a $1,550 debit balance. (if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

Answers: 3

Business, 22.06.2019 22:10

Scoresby co. uses 6 machine hours and 2 direct labor hours to produce product x. it uses 8 machine hours and 16 direct labor hours to produce product y. scoresby's assembly and finishing departments have factory overhead rates of $240 per machine hour and $160 per direct labor hour, respectively. how much overhead cost will be charged to the two products? a. product x = $1,440; product y = $2,560 b. product x = $1,760; product y = $4,480 c. product x = $3,200; product y = $9,600 d. product x = $800; product y = $800

Answers: 1

You know the right answer?

Identify each of the following reconciling items as: an addition to the cash balance according to th...

Questions

Mathematics, 10.04.2020 00:26

Mathematics, 10.04.2020 00:26

Computers and Technology, 10.04.2020 00:26

History, 10.04.2020 00:26

History, 10.04.2020 00:26

Mathematics, 10.04.2020 00:26

Mathematics, 10.04.2020 00:26

Mathematics, 10.04.2020 00:26

Mathematics, 10.04.2020 00:26

Mathematics, 10.04.2020 00:26

Mathematics, 10.04.2020 00:26

Social Studies, 10.04.2020 00:26