Balance sheet (partial) stockholders’ equity paid-in capital preferred stock, cumulative, 11,833 shares authorized, 7,100 shares issued and outstanding $ 710,000 common stock, no par, 717,672 shares authorized, 555,000 shares issued 1,665,000 total paid-in capital 2,375,000 retained earnings 1,151,000 total paid-in capital and retained earnings 3,526,000 less: treasury stock (7,000 common shares) 37,333 total stockholders’ equity $3,488,667 from a review of the stockholders’ equity section, answer the following questions.

(a) how many shares of common stock are outstanding?

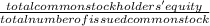

common stock outstanding 543000 shares

(b) assuming there is a stated value, what is the stated value of the common stock?

the stated value of the common stock $ per share

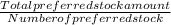

(c) what is the par value of the preferred stock?

the par value of the preferred stock $ per share

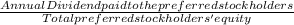

(d) if the annual dividend on preferred stock is $49,700, what is the dividend rate on preferred stock?

the dividend rate %

(e) if dividends of $71,400 were in arrears on preferred stock, what would be the balance reported for retained earnings?

the retained earnings balance $

Answers: 1

Another question on Business

Business, 22.06.2019 03:10

Transactions that affect earnings do not necessarily affect cash. identify the effect, if any, that each of the following transactions would have upon cash and net income. the first transaction has been completed as an example. (if an amount reduces the account balance then enter with negative sign preceding the number e.g. -15,000 or parentheses e.g. (15, cash net income (a) purchased $120 of supplies for cash. –$120 $0 (b) recorded an adjustment to record use of $35 of the above supplies. (c) made sales of $1,370, all on account. (d) received $700 from customers in payment of their accounts. (e) purchased equipment for cash, $2,450. (f) recorded depreciation of building for period used, $740. click if you would like to show work for this question: open show work

Answers: 3

Business, 22.06.2019 13:40

Determine if the following statements are true or false. an increase in government spending can crowd out private investment. an improvement in the budget balance increases the demand for financial capital. an increase in private consumption may crowd out private investment. lower interest rates can lead to private investment being crowded out. a trade balance in sur+ increases the supply of financial capital. if private savings is equal to private investment, then there is neither a budget sur+ nor a budget deficit.

Answers: 1

Business, 22.06.2019 14:20

Frugala is when sylvestor puts $2,000 into 10-year state bonds and $3,000 into 5-year aaa-rated bonds in steady hand hardware, inc. he buys the four state bonds at a 5 percent interest rate and the three steady hand bonds at a 6.5 percent rate. sylvestor also buys $1,500 worth of blue chip stocks, and $800 worth of stock in a promising new sportswear company that reinvests its earnings in new growth. 1. (a) what is the maturity for each of the bond groups sylvestor buys? (b) the coupon rate? (c) the par value?

Answers: 3

Business, 22.06.2019 19:00

Adrawback of short-term contracting as an alternative to making a component in-house is thata. it is the most-integrated alternative to performing an activity so the principal company has no control over the agent. b. the supplying firm has no incentive to make any transaction-specific investments to increase performance or quality. c. it fails to allow a long planning period that individual market transactions provide. d. the buying firm cannot demand lower prices due to the lack of a competitive bidding process.

Answers: 2

You know the right answer?

Balance sheet (partial) stockholders’ equity paid-in capital preferred stock, cumulative, 11,833 sha...

Questions

Physics, 09.01.2021 04:10

History, 09.01.2021 04:10

Mathematics, 09.01.2021 04:10

Mathematics, 09.01.2021 04:10

English, 09.01.2021 04:10

Computers and Technology, 09.01.2021 04:10

English, 09.01.2021 04:20

Biology, 09.01.2021 04:20

Mathematics, 09.01.2021 04:20

x 100

x 100 x 100

x 100