Business, 30.11.2019 06:31 genyjoannerubiera

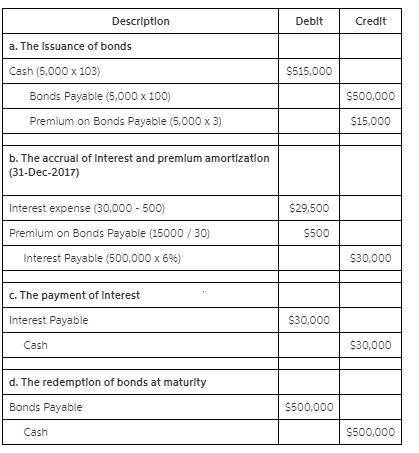

Sehr company issued $500,000, 6%, 30-year bonds on january 1, 2022, at 103. interest is payable annually on january 1. sehr uses straight-line amortization for bond premium or discount.

required :

prepare the journal entries to record the following events.

(a) the issuance of the bonds.

(b) the accrual of interest and the premium amortization on december 31, 2022.

(c) the payment of interest on january 1, 2023.

(d) the redemption of the bonds at maturity, assuming interest for the last interest period has been paid and recorded.

Answers: 1

Another question on Business

Business, 22.06.2019 07:40

Myflvs -question 3 multiple choice worth 2 points)(10.04 hc)in panama city in january, high tide was at midnight. the water level at high tide was 9 feet and1 foot at low tide. assuming the next high tide is exactly 12 hours later and that the height of thewater can be modeled by a cosine curve, find an equation for water level in january for panamacity as a function of time (t).of(t) = 4 + 5of(t) = 5 cost + 4o 460) = 5 cos 1+ 4of(0) = 4 cos + 5

Answers: 1

Business, 22.06.2019 12:50

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

Business, 22.06.2019 16:10

Omnidata uses the annualized income method to determine its quarterly federal income tax payments. it had $100,000, $50,000, and $90,000 of taxable income for the first, second, and third quarters, respectively ($240,000 in total through the first three quarters). what is omnidata's annual estimated taxable income for purposes of calculating the third quarter estimated payment?

Answers: 1

You know the right answer?

Sehr company issued $500,000, 6%, 30-year bonds on january 1, 2022, at 103. interest is payable annu...

Questions

Mathematics, 25.03.2021 01:00

Mathematics, 25.03.2021 01:00

Biology, 25.03.2021 01:00

Mathematics, 25.03.2021 01:00

Mathematics, 25.03.2021 01:00

Mathematics, 25.03.2021 01:00

Business, 25.03.2021 01:00