Business, 30.11.2019 06:31 dessssimartinez6780

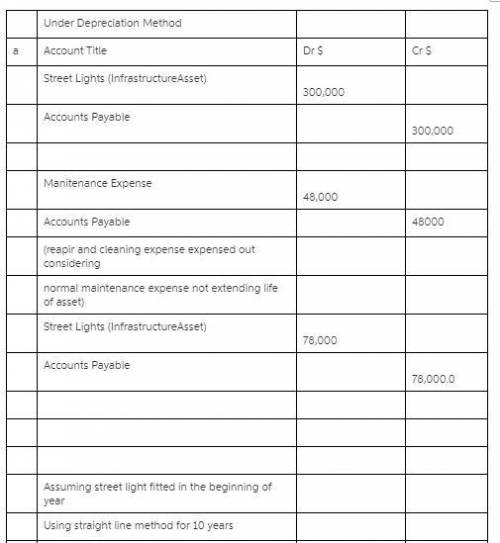

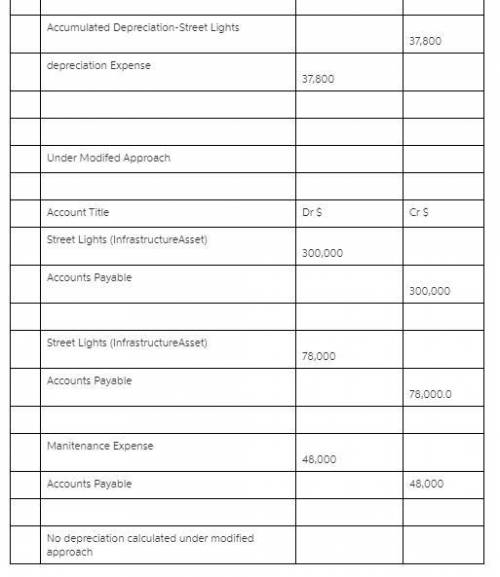

Acity government adds street lights within its boundaries at a total cost of $300,000. the lights should burn for at least 10 years but can last significantly longer if maintained properly. the city sets up a system to monitor these lights with the goal that 97 percent will be working at any one time. during the year, the city spends $48,000 to clean and repair the lights so that they are working according to the specified conditions. however, it spends another $78,000 to construct lights for several new streets in the city. a. prepare the entries assuming infrastructure assets are capitalized with depreciation recorded. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field.)

Answers: 3

Another question on Business

Business, 22.06.2019 10:10

Ursus, inc., is considering a project that would have a five-year life and would require a $1,650,000 investment in equipment. at the end of five years, the project would terminate and the equipment would have no salvage value. the project would provide net operating income each year as follows (ignore income taxes.):

Answers: 1

Business, 23.06.2019 01:00

The huntington boys and girls club is conducting a fundraiser by selling chili dinners to go. the price is $7 for an adult meal and $4 for a child’s meal. write a program that accepts the number of adult meals ordered and then children's meals ordered. display the total money collected for adult meals, children’s meals, and all meals.

Answers: 2

Business, 23.06.2019 12:30

Mason farms purchased a building for $689,000 eight years ago. six years ago, repairs costing $136,000 were made to the building. the annual taxes on the property are $11,000. the building has a current market value of $840,000 and a current book value of $494,000. the building is totally paid for and solely owned by the firm. if the company decides to use this building for a new project, what value, if any, should be included in the initial cash flow of the project for this building? $0$582,000$840,000$865,000$953,000

Answers: 3

Business, 23.06.2019 17:30

When signing a lease for a retail space, it's important to make sure the lease has a clause, which releases the tenant from the lease if sales don't reach an agreed-upon amount.

Answers: 1

You know the right answer?

Acity government adds street lights within its boundaries at a total cost of $300,000. the lights sh...

Questions

Mathematics, 18.09.2019 15:50

Health, 18.09.2019 15:50

Mathematics, 18.09.2019 15:50

Spanish, 18.09.2019 15:50

Business, 18.09.2019 15:50

Mathematics, 18.09.2019 15:50

Mathematics, 18.09.2019 15:50

History, 18.09.2019 15:50

History, 18.09.2019 15:50

Mathematics, 18.09.2019 15:50

Geography, 18.09.2019 15:50

Chemistry, 18.09.2019 15:50