Business, 02.12.2019 18:31 tiearahill2393

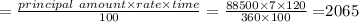

On june 8, alton co. issued an $88,500, 7%, 120-day note payable to seller co. assume that the fiscal year of seller co. ends june 30. using a 360-day year in your calculations, what is the amount of interest revenue recognized by seller in the following year? when required, round your answer to the nearest dollar.

Answers: 1

Another question on Business

Business, 22.06.2019 07:30

Which of the following best describes why you need to establish goals for your program?

Answers: 3

Business, 22.06.2019 09:30

An object that is clicked on and takes the presentation to a new targeted file is done through a

Answers: 2

Business, 22.06.2019 10:40

What would happen to the equilibrium price and quantity of lattés if the cost to produce steamed milk

Answers: 1

Business, 22.06.2019 14:30

What’s the present value of a perpetuity that pays $250 per year if the appropriate interest rate is 5%? $4,750 $5,000 $5,250 $5,513 $5,788what is the present value of the following cash flow stream at a rate of 8.0%, rounded to the nearest dollar? cash flows: today (t = 0) it is $750, after one year (t = 1) it is $2,450, at t = 2 it is $3,175, and at t=3 it is $4,400. draw a time line. $7,917 $8,333 $8,772 $9,233 $9,695

Answers: 2

You know the right answer?

On june 8, alton co. issued an $88,500, 7%, 120-day note payable to seller co. assume that the fisca...

Questions

Physics, 24.10.2020 07:40

Mathematics, 24.10.2020 07:40

Mathematics, 24.10.2020 07:40

History, 24.10.2020 07:40

Mathematics, 24.10.2020 07:40

Mathematics, 24.10.2020 07:40

History, 24.10.2020 07:40

Chemistry, 24.10.2020 07:40

Arts, 24.10.2020 07:40

Mathematics, 24.10.2020 07:40

Computers and Technology, 24.10.2020 07:40

Mathematics, 24.10.2020 07:40

Mathematics, 24.10.2020 07:40

Chemistry, 24.10.2020 07:40