Business, 03.12.2019 01:31 allisonzawodny3533

On january 1, 2017, bensen company leased equipment to flynn corporation. the following information pertains to this lease.

the term of the non-cancelable lease is 6 years. at the end of the lease term, flynn has the option to purchase the equipment for $1,000, while the expected residual value at the end of the lease is $5,000.

equal rental payments are due on january 1 of each year, beginning in 2017.

the fair value of the equipment on january 1, 2017, is $150,000, and its cost is $120,000.

the equipment has an economic life of 8 years. flynn depreciates all of its equipment on a straight-line basis.

bensen set the annual rental to ensure a 5% rate of return. flynn's incremental borrowing rate is 6%, and the implicit rate of the lessor is unknown.

collectibility of lease payments by the lessor is probable. (both the lessor and the lessee's accounting periods end on december 31.)

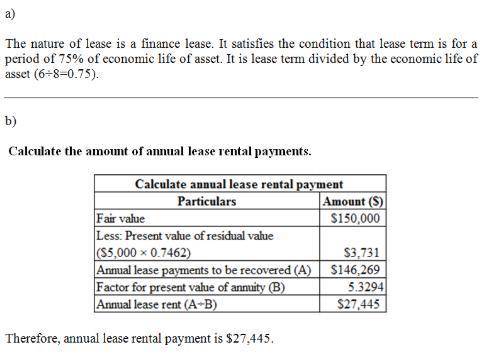

(a) discuss the nature of this lease to bensen and flynn.

(b) calculate the amount of the annual rental payment.

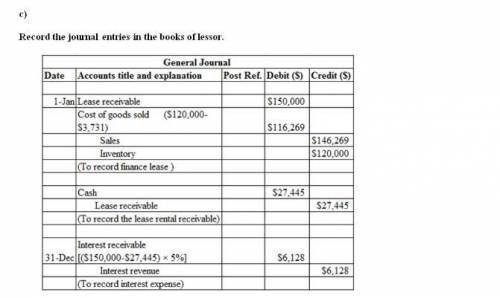

(c) prepare all the necessary journal entries for bensen for 2017.

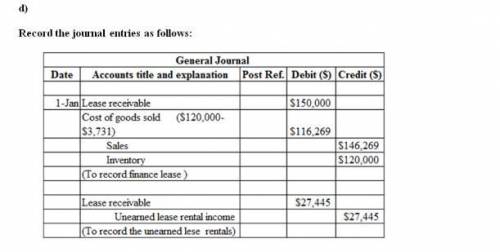

(d) suppose the collectibility of the lease payments was not probable for bensen. prepare all necessary journal entries for the company in 2017.

(e) prepare all the necessary journal entries for flynn for 2017.

(f) discuss the effect on the journal entry for flynn at lease commencement, assuming initial direct costs of $2,000 are incurred by flynn to negotiate the lease.

Answers: 3

Another question on Business

Business, 22.06.2019 20:00

If a government accumulates chronic budget deficits over time, what's one possible result? a. a collective action problem b. a debt crisis c. regulatory capture d. an unfunded liability

Answers: 2

Business, 22.06.2019 21:00

After hearing a knock at your front door, you are surprised to see the prize patrol from a large, well-known magazine subscription company. it has arrived with the good news that you are the big winner, having won $21 million. you have three options.(a) receive $1.05 million per year for the next 20 years.(b) have $8.25 million today.(c) have $2.25 million today and receive $750,000 for each of the next 20 years.your financial adviser tells you that it is reasonable to expect to earn 13 percent on investments.

Answers: 3

Business, 23.06.2019 00:40

You are a team of marketing consultants. it is 2008 and the great recession has struck. one of your clients is whole foods market (sometimes known as whole paycheck). wfm has come to you and asked for strategic advice on how to adapt their product and pricing strategies in light of the economic downturn: 1. advise wfm on the various approaches that could be taken to reducing price. be sure to consider potential psychological impact of price reductions on wfm consumers. 2. based on the options outlined in part 1, recommend an approach and support with marketing theory.

Answers: 2

Business, 23.06.2019 06:00

Part two of threewhich accurately describes a cause for inflation? the federal reserve requires banks to keep more money on reserve. the federal reserve raises interest rates and slows economic activity. the government places too much money into circulation. the government places too little money into circulation. what are consequences of rapid inflation? (select all that apply.) savings accounts become less desirable because interest earned is lower than inflation individual purchasing power increases, which results in an increase in demand. individual purchasing power decreases, which results in a decrease in demand. people postpone purchasing expensive items, such as homes, until prices drop.how does the federal reserve stabilize and safeguard the nation’s economy? (select all that apply.) it distributes currency and oversees fiscal conditions. it implements american monetary policy. it regulates banks and defends consumer credit rights. it regulates and oversees the nasdaq stock exchange. what are functions of the federal reserve? (select all that apply.) it offers financial services within the government. it creates us coins. it prints us dollars. it enters us currency into circulation.how does the federal reserve bank fit into the balance of power among the three branches of the federal government established by the constitution? the chair of the federal reserve is appointed by the president and approved by the senate. the chair of the federal reserve is elected by popular vote. the chair of the federal reserve is appointed by congress and approved by the supreme court. the chair of the federal reserve is appointed in a secret meeting.who appoints the board of governors of the federal reserve system? the us president the us supreme court the us house of representatives the us senatewhy is federal oversight crucial to the operation of the federal reserve bank? the federal reserve is the nation’s central banking system. the federal reserve controls the nomination of legislators to committees. the federal reserve funds mandatory government expenditures. the federal reserve sets rules and regulations for the new york stock exchange.what is the government accountability office (gao)? an independent agency that answers to congress and audits the federal reserve an internal review agency of the federal reserve used to promote its mission a government agency that answers to congress and audits the united states mint a private agency that advises the dent about fiscal policyhow does the law of comparable advantage lead to international trade? countries that do not engage in trade are in a stronger position economically than countries that do trade. countries that cannot produce products efficiently have to trade for the goods and services that other countries have. countries that have more resources are able to trade for a wider variety of items that can be offered for sale. countries make products they can produce efficiently and are able to get the rest of what they need through trade.when might a country produce a product even though it cannot do so efficiently? (select all that apply.) to ensure national security to minimize the sale of exports to ensure a trade deficit to increase the balance of trade

Answers: 3

You know the right answer?

On january 1, 2017, bensen company leased equipment to flynn corporation. the following information...

Questions

Mathematics, 24.04.2020 21:30

Mathematics, 24.04.2020 21:30

Computers and Technology, 24.04.2020 21:30

History, 24.04.2020 21:30

English, 24.04.2020 21:30

Mathematics, 24.04.2020 21:30

Mathematics, 24.04.2020 21:30

Mathematics, 24.04.2020 21:30

Mathematics, 24.04.2020 21:30