Business, 04.12.2019 00:31 blairjaneaoyrfvp

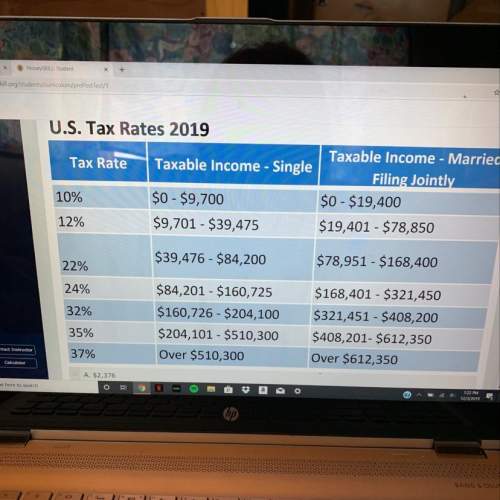

Using the 2019 tax table, how much federal income tax will sasha owe if she earns $16 per hour for 2,000 hours of work per year and has a standard deduction of $12,200?

Answers: 3

Another question on Business

Business, 22.06.2019 10:20

Blue spruce corp. has the following transactions during august of the current year. aug. 1 issues shares of common stock to investors in exchange for $10,170. 4 pays insurance in advance for 3 months, $1,720. 16 receives $710 from clients for services rendered. 27 pays the secretary $740 salary. indicate the basic analysis and the debit-credit analysis.

Answers: 1

Business, 22.06.2019 11:40

Define the marginal rate of substitution between two goods (x and y). if a consumer’s preferences are given by u(x,y) = x3/4y1/4, compute the consumer’s marginal rate of substitution as a function of x and y. calculate the mrs if the consumer has chosen to consumer 48 units of x and 16 units of y. show your work. (use the back of the page if necessary.

Answers: 3

Business, 22.06.2019 18:00

In which job role will you be creating e-papers, newsletters, and periodicals?

Answers: 1

Business, 22.06.2019 19:20

Win goods inc. is a large multinational conglomerate. as a single business unit, the company's stock price is estimated to be $200. however, by adding the actual market stock prices of each of its individual business units, the stock price of the company as one unit would be $300. what is win goods experiencing in this scenario? a. diversification discount b. learning-curveeffects c. experience-curveeffects d. economies of scale

Answers: 1

You know the right answer?

Using the 2019 tax table, how much federal income tax will sasha owe if she earns $16 per hour for 2...

Questions

Chemistry, 11.09.2021 06:30

Arts, 11.09.2021 06:30

Health, 11.09.2021 06:30

Social Studies, 11.09.2021 06:30

Mathematics, 11.09.2021 06:30

English, 11.09.2021 06:30