Business, 04.12.2019 02:31 zhellyyyyy

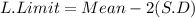

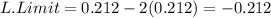

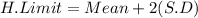

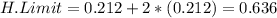

The average annual return over the period 1926-2009 for small stocks is 21.2%, and the standard

deviation of returns is 21.2%. based on these numbers, what is a 95% confidence interval for

2010 returns?

a) -10.6%, 31.8%

b) 0%, 42.4%

c) -21.2%, 42.4%

d) -21.2%, 63.6%

Answers: 3

Another question on Business

Business, 22.06.2019 03:00

In the supply-and-demand schedule shown above, at the lowest price of $50, producers supply music players and consumers demand music players.

Answers: 2

Business, 22.06.2019 10:10

True tomato inc. makes organic ketchup. to promote its products, this firm decided to make bottles in the shape of tomatoes. to accomplish this, true tomato worked with its bottle manufacture to create a set of unique molds for its bottles. which of the following specialized assets does this example demonstrate? (a) site specificity (b) research specificity (c) physical-asset specificity (d) human-asset specificity

Answers: 3

Business, 22.06.2019 12:30

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 22:00

Gyou are in charge of making the work schedule for the next two weeks. typically this is not a difficult task as you work at a routine 8am – 5pm company. however, over the next two weeks you are required to schedule someone to be in the office each saturday. after contemplating this for a few days you make the schedule and assignments. before posting the schedule for everyone you decide that it is a good idea to meet personally with the two people you have scheduled to work the weekend. what do you say to them? what is your desired outcome?

Answers: 3

You know the right answer?

The average annual return over the period 1926-2009 for small stocks is 21.2%, and the standard

Questions

Mathematics, 21.10.2019 22:30

Mathematics, 21.10.2019 22:30

Biology, 21.10.2019 22:30

Social Studies, 21.10.2019 22:30

History, 21.10.2019 22:30

Mathematics, 21.10.2019 22:30

Mathematics, 21.10.2019 22:30

Physics, 21.10.2019 22:30

Chemistry, 21.10.2019 22:30

Chemistry, 21.10.2019 22:30

Mathematics, 21.10.2019 22:30

Mathematics, 21.10.2019 22:30