Business, 04.12.2019 03:31 xwilliams83

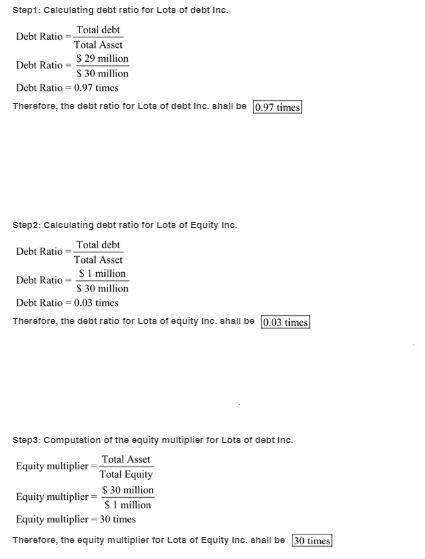

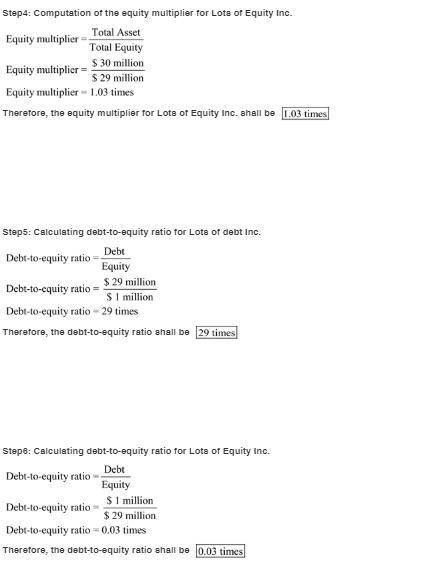

Debt management ratios you are considering a stock investment in one of two firms (lotsofdebt, inc. and lotsofequity, both of which operate in the same industry. lotsofdebt, inc. finances its $30 million in assets with $29 million in debt and $1 million in equity. lotsofequity, inc. finances its $30 million in assets with $1 million in debt and $29 million in equity. calculate the debt ratio and equity multiplier for the two firms.

Answers: 3

Another question on Business

Business, 21.06.2019 18:30

Which stroke of the four-stroke cycle is shown in the above figure? a. power b. compression c. exhaust d. intake

Answers: 2

Business, 22.06.2019 02:00

Corporations with suppliers, vendors, and customers all over the globe are referred to as : a) global corporations b) international corporations c) multinational corporations d) multicultural corporations

Answers: 2

Business, 22.06.2019 09:50

Is exploiting a distinctive competence or improving efficiency for competitive advantage. (a) cooptation (b) coalition (c) competitive intelligence (d) competitive aggression (e) smoothing

Answers: 1

Business, 22.06.2019 23:00

To increase sales, robert sends out a newsletter to his customers each month, letting them know about new products and ways in which to use them. in order to protect his customers' privacy, he uses this field when addressing his e-mail. attach bcc forward to

Answers: 2

You know the right answer?

Debt management ratios you are considering a stock investment in one of two firms (lotsofdebt, inc....

Questions

Biology, 20.09.2020 09:01

SAT, 20.09.2020 09:01

Social Studies, 20.09.2020 09:01

Mathematics, 20.09.2020 09:01

Mathematics, 20.09.2020 09:01

English, 20.09.2020 09:01

Mathematics, 20.09.2020 09:01

Mathematics, 20.09.2020 09:01

History, 20.09.2020 09:01

Mathematics, 20.09.2020 09:01

English, 20.09.2020 09:01